Advertisement|Remove ads.

Ixigo Soars To New Highs On Stellar Q1: SEBI RA Notes Bullish Momentum With Margin Risk

Shares of Le Travenues, the parent company of Ixigo, hit a fresh high on Thursday after the company reported record revenue and profits across key verticals in its first-quarter earnings (Q1 FY26).

Ixigo shares surged 14% testing a fresh 52-week high at ₹206.

Q1 net profit rose 27.7% to ₹18.9 crore from ₹14.8 crore last year (YoY), while revenues soared 74.2% to ₹314.4 crore.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) increased 53.1% to ₹25.5 crore (YoY), though margins slightly dipped to 8.10% vs 9.15% last year.

During the June quarter, Ixigo's business growth was driven by newer verticals. The flights and buses sectors also maintained a strong performance.

SEBI-registered analyst Palak Jain noted that Ixigo’s strong revenue growth indicates a robust business model, while its increasing EBITDA shows improving operational efficiency.

She cautioned that margin contraction might impact profitability in the short term. Overall, Ixigo’s Q1 results showcase a strong performance, driven by revenue growth and operational efficiency. Jain added that investors should keep an eye on margin trends.

On the technical side, Ixigo's stock price has been in an uptrend, with higher highs and higher lows. The stock is trading above its 50-day and 200-day moving averages, indicating a strong bullish trend.

Jain identified support between ₹180 and ₹165 and resistance at ₹210-₹224.

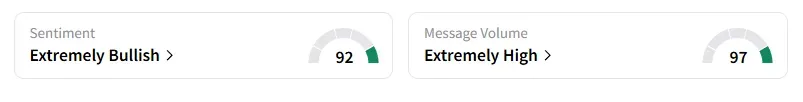

Data on Stocktwits shows that retail sentiment has surged to ‘extremely bullish’ amid ‘very high’ message volumes a day earlier.

Ixigo shares have gained 21% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)