Advertisement|Remove ads.

Jack Dorsey’s Block Surges To 5-Month High As S&P 500 Inclusion Sparks Retail Buzz, Analyst Cheer

Block Inc. (XYZ) saw a sharp uptick in retail trader interest on Monday after it was selected to replace Hess Corp. in the S&P 500 index.

Shares of the Jack Dorsey-led fintech firm jumped more than 7.2% in the regular session, hitting its highest level since February, boosted by the index news and a series of price target hikes from Wall Street analysts. The stock is slated to join the benchmark index on Wednesday, replacing Hess Corp, which Chevron's $53 billion acquisition will absorb.

Block's inclusion in the S&P 500 marks another milestone for the firm, which offers point-of-sale systems, payment processing, and bitcoin-related services. Entry into the index could bring a broader investor base, as index-tracking funds are required to add the stock to their portfolios.

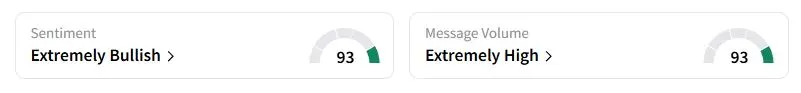

Retail sentiment on Stocktwits was in the 'extremely bullish' zone at the time of writing, with message volume spiking 364% over the past 24 hours.

JPMorgan raised its price target on the stock from $60 to $90 and reiterated an 'Overweight' rating. The firm called the S&P 500 inclusion a source of "more positive energy" for shares, estimating net indexer demand at 54.2 million shares.

"We believe XYZ deserves a higher multiple given recent momentum around product velocity and marketing efforts, and joining S&P 500 helps," JPMorgan wrote.

Bernstein analyst Harshita Rawat also lifted her price target from $75 to $90 and maintained an 'Outperform' rating, citing improved fundamentals. She called the stock's valuation "undemanding" at 23x GAAP earnings, especially given that around 17% of Block's market cap is in cash.

While the stock is already popular among hedge funds, she noted that long-only investors may begin to pile in after its inclusion in the S&P 500.

Benchmark followed suit, raising its target to $90 from $75, noting that the valuation still offers upside as performance improves.

Block's market capitalization rose to $48 billion after Monday's rally. Founded by Jack Dorsey and Jim McKelvey as Square, the company rebranded to Block to reflect its expanded scope beyond payments. As the parent company of Square and Cash App, Block has steadily captured a significant market share in the point-of-sale technology sector.

"Been holding since 2022 and still waiting patiently. I don't mind if it dips again so I can buy more," one retail trader wrote on Stocktwits.

Despite Monday's surge, Block shares remain down 9.4% year-to-date. The company is expected to report second-quarter earnings on Aug. 7.

Also See: GameSquare Ignites Retail Buzz With $250M Crypto Strategy And NFT Yields

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)