Advertisement|Remove ads.

JD.com Stock Rises After New $5 Billion Share Repurchase Program: Retail Investors Exuberant

Shares of JD.com (JD) jumped over 2% on Tuesday after the firm announced a $5 billion share repurchase program that may be conducted over the next 36 months through the end of August 2027.

This marks the second time this year the Chinese e-commerce giant has announced a share buyback plan. Back in February, JD.com announced a $3 billion buyback initiative.

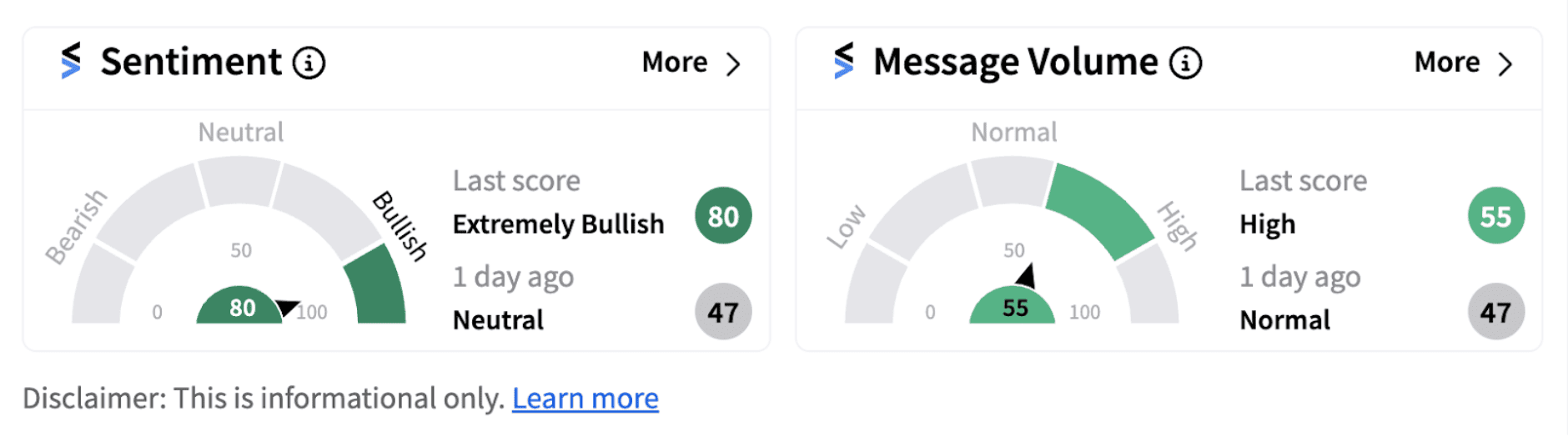

Following the announcement, retail sentiment on Stocktwits flipped into ‘extremely bullish’ territory (80/100) from ‘neutral’ zone a day ago.

Two weeks earlier, JPMorgan had upgraded JD.com to ‘Overweight’ from ‘Neutral’ while raising the price target to $36 from $33. The analyst noted that the firm’s shift in strategy change and valuation have reached an inflection point for the stock to ‘outperform’ over the next 12 months.

The upgrade followed the company’s strong second-quarter earnings repoprt, with net revenue rising 1.2% year-over-year (YoY) to $40.1 billion and earnings per share (EPS) surging over 97% to RMB8.19 ($1.13).

The company’s net income almost doubled to RMB12.6 billion ($1.7 billion) from RMB6.6 billion a year earlier. Net margin attributable to the company's ordinary shareholders came in at 4.3% compared to 2.3% in the year-ago period.

JD.com recently made news after Walmart (WMT) sold its entire stake in the Chinese firm, offloading about 144.5 million shares for $24.95 apiece to raise about $3.6 billion, as part of revamping its strategy in China where retail players have been struggling amid a weak economy. With the stake sale, the American retail giant ended a partnership that began in 2016 when it acquired a 5% stake in the firm.

Messages on JD’s Stocktwits steam have been overwhelmingly positive based on the latest development.

One user named ‘TradeMaster11’ highlighted the relatively lower valuation of the firm, calling it the ‘Amazon of China.’

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)