Advertisement|Remove ads.

Jim Cramer Says SoftBank’s Acquisition Of Foxconn’s Ohio Plant, Meta’s $29 Billion Pimco Deal Will Boost Data Center Story

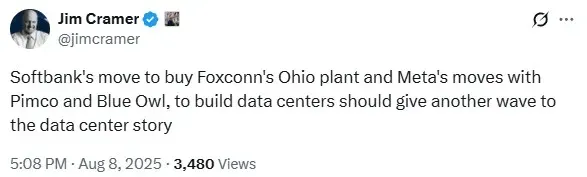

Jim Cramer on Friday said that the data center story will get a boost following two major deals by Meta Platforms Inc. (META) and SoftBank Group Corp. (SFTBY).

In a post on X, the ‘Mad Money’ host sounded optimistic about Meta’s $29 billion deal with Pacific Investment Management Co. and Blue Owl Capital Inc. (OWL), and SoftBank’s acquisition of Apple supplier Foxconn’s Ohio plant.

Meta has chosen Pacific Investment Management and Blue Owl Capital to lead a $29 billion financing round for its data center expansion plans, according to a Bloomberg report.

Meta’s shares traded 0.05% higher in Friday’s pre-market session. Stocktwits data showed the retail sentiment around the company on the platform was in the ‘bearish’ territory.

According to the report, Pimco is expected to lead a $26 billion debt financing round for Meta’s data expansion efforts in Louisiana. The remaining $3 billion fundraising would be through the equity route, but final details are not known yet.

Earlier on Friday, Masayoshi Son-led SoftBank acquired Foxconn’s Ohio plant, according to a Bloomberg report, as the company looks to push its $500 billion Stargate data center project announced earlier this year with OpenAI and Oracle Corp. (ORCL).

The Foxconn plant in question is an electric vehicle facility, and the deal is valued at $375 million, according to the report.

In March, during Nvidia Corp.’s (NVDA) annual GTC event, CEO Jensen Huang said data center buildouts are expected to hit the $1 trillion mark by 2028.

META’s stock is up 30% year-to-date and 49% over the past 12 months.

Also See: Dow Futures Rise As Investors Shift Focus To Earnings: FLY, XYZ, SOUN, TTD Among Stocks To Watch

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)