Advertisement|Remove ads.

Jim Cramer Says Weak Nvidia Price Presents Entry Opportunity: Report

- Jim Cramer said he remains confident in Nvidia, and added that the stock is being undervalued.

- He said that despite short-term jitters, the appetite for Nvidia’s GPUs is “insatiable.”

- The broader tech market has felt the strain from a sharp increase in projected capital expenditure by major companies.

Jim Cramer has reportedly called NVIDIA Corp.’s (NVDA) recent share price dip a golden chance for investors to buy into the AI chipmaker.

Nvidia’s stock tumbled over 4% on Tuesday afternoon following a report that Meta Platforms Inc. (META) is exploring the use of Google’s Tensor Processing Units (TPUs) for its data centers in 2027.

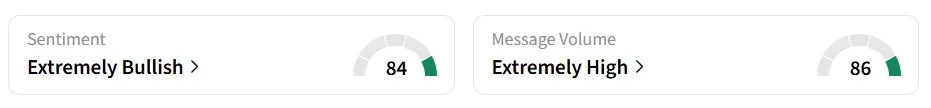

However, on Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Cramer’s Case For Buying

Speaking on CNBC’s “Squawk on the Street,” Cramer said he remains confident in Nvidia, and added that the stock is being undervalued. He highlighted Nvidia’s recent $500 billion in order visibility for its Blackwell and upcoming Vera Rubin platforms, and noted that the stock trades at a surprisingly modest P/E ratio.

According to Cramer, despite short-term jitters, the appetite for Nvidia’s GPUs is “insatiable.” He stated that, even though some customers are sensitive to price, there’s no sign of a demand drop that would warrant a major selloff.

Concerns Over Valuations

Nvidia’s stock has been under pressure, falling for the fourth consecutive week in November, as investors take notice and express concern about its high valuation.

The broader tech market has also felt the strain from a sharp increase in projected capital expenditure by major companies.

However, the AI bellwether reported another blowout quarterly performance in the third quarter, allaying fears of an AI bubble.

Deepwater Asset Management Managing Partner Gene Munster said Nvidia’s guidance suggested that, despite investor jitters, the AI infrastructure boom is far from peaking.

NVDA stock has gained over 31% in 2025 and over 29% in the last 12 months.

Also See: Citi Upgrades Brinker To Buy, Sees 25% Upside

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)