Advertisement|Remove ads.

JK Paper, Ajanta Pharma Breakout Watch: SEBI RA Dhruv Tuli Flags Bullish Charts

SEBI-registered analyst Dhruv Tuli has identified two stocks poised for a breakout on their weekly charts. He is bullish on JK Paper and Ajant Pharma, driven by their strong technical and momentum indicators, and sees swing trade opportunities for medium-term investors.

JK Paper

Dhruv Tuli spotted a strong breakout in JK Paper, with its stock price reclaiming key levels above both the 50- and 200-day Exponential Moving Averages (EMAs) on the weekly chart.

The combination of a volume confirmation and an RSI breakout from a multi-year downtrend indicates that bullish momentum is brewing in this small-cap stock.

Tuli adds that the previous resistance zone is now acting as support, and he sees a potential 35-40% upside from the current levels. It structure looks clean for a positional swing trade.

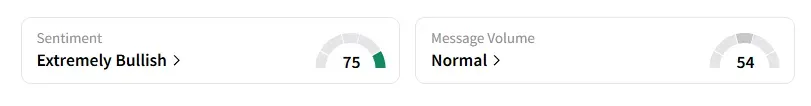

Data on Stocktwits shows that retail sentiment is ‘extremely bullish’ on this counter.

JK Paper shares have fallen % 3year-to-date (YTD).

Ajanta Pharma

Tuli noted that Ajanta Pharma is consolidating under a clean falling trendline, now showing signs of a breakout. Technical indicators indicate that its support from both the 50-day EMA (₹2,626) and the 200-day EMA (₹2,034) remains intact, while the RSI establishes a long-term bullish base. If Ajanta Pharma breaks and closes above the trendline, it could trigger a fresh uptrend.

Volumes are picking up, and the bullish RSI divergence is a strong signal for accumulation. Tuli advises that breakout confirmation presents a buy-on-dips opportunity for medium-term targets.

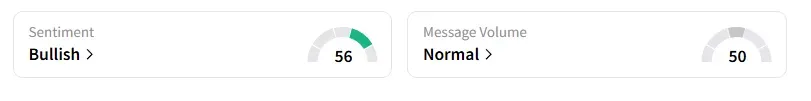

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

Ajanta Pharma shares have fallen 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)