Advertisement|Remove ads.

JK Tyre & Industries Shares Likely To Rise 20% Over Next 6-9 Months: SEBI RA Finversify

JK Tyre & Industries Ltd shares can potentially rise by 20% within the next six to nine months following its strong technical breakout, according to SEBI-registered research firm Finversify.

After releasing its fourth-quarter (Q4) results, the company's stock rose by 12%.

According to Finversify, JK Tyre shows resilience despite reporting mixed earnings outcomes.

At the time of writing, JK Tyre & Industries shares were trading at ₹380.05, down 3.42% or ₹13.45.

The company posted a 42.6% reduction in net profit year-over-year to ₹97 crore but saw revenue growth of 1.63%, reaching ₹3,780 crore.

The company also reported a 15% quarter-over-quarter increase in EBITDA, which reached ₹384 crore.

Finversify said JK Tyre's continuous expansion of premium products and sustainable initiatives will likely further drive stock growth.

The research firm advises a target price of ₹475 and a stop-loss level at ₹345.

JK Tyre & Industries recently started producing passenger car tyres using ISCC Plus-certified sustainable raw materials at its Chennai plant, launching the UX Royale Green tyres.

The certification ensures the use of traceable, responsibly sourced, renewable, and recycled materials.

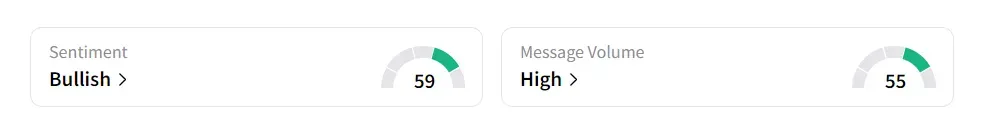

On Stocktwits, retail sentiment was ‘bullish’ amid ‘high’ message volume.

JK Tyres shares have declined 1.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)