Advertisement|Remove ads.

Joby Stock Surges Post L3Harris Collaboration, JPMorgan Price Target Hike: Retail’s Skeptical

California-based air taxi company Joby Aviation, Inc. (JOBY) said on Friday that it is exploring opportunities to develop a new vertical take-off and landing aircraft for defense purposes with L3Harris Technologies (LHX).

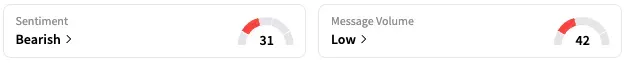

JOBY shares rose 6% in morning trade at the time of writing. On Stocktwits, retail sentiment around JOBY trended in the ‘bearish’ territory, coupled with ‘low’ message volume.

A Stocktwits user sounded skeptical following the announcement.

Another user believes the stock could see more dilution.

Joby said that the new aircraft class could be used for a range of low-altitude support use cases.

While testing of the aircraft will start in the fall this year, operational demonstrations are planned for 2026. It will bring together Joby’s commercial aircraft development program with L3Harris’ expertise on platform missionization, including sensors and effectors.

Gas turbine hybrid vertical take-off and landing (VTOL) aircraft are designed for low altitude missions and can be operated with a crew or fully autonomously, the company noted.

The company added that it is actively developing a gas turbine hybrid powertrain for its current S4 five-seater eVTOL air taxi aircraft.

JPMorgan on Friday raised its price target on Joby Aviation to $7 from $5 while keeping an ‘Underweight’ rating on the shares. However, the new price target implies nearly 58% downside to the stock’s closing price on Thursday.

The firm said that it views the recent outperformance in the electric vertical take-off and landing sector as "irrational exuberance."

While President Trump's executive order is a positive signal around the government's support for eVTOL, any further developments are unlikely to impact company earnings materially in the near term, the analyst told investors in a research note.

JPMorgan thinks significant cash burn and further revenue push-outs should be better reflected in shares.

JOBY stock has more than doubled its value this year and tripled over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)