Advertisement. Remove ads.

Johnson & Johnson To Acquire Medical Device-Maker V-Wave: Retail Turns ‘Bullish’

Johnson & Johnson is set to acquire medical device-maker V-Wave for an upfront payment of $600 million with the potential for additional regulatory and commercial milestone payments up to approximately $1.10 billion. Following the acquisition, V-Wave will join Johnson & Johnson as part of Johnson & Johnson MedTech.

Established in 2009, V-Wave is a privately held medical device company and is focused on developing innovative treatment options for people living with heart failure and cardiovascular disease.

Johnson & Johnson believes the transaction will further accelerate the firm’s shift into high-growth and high-opportunity markets while deepening its relationships with structural interventional cardiologists and heart failure specialists. The deal is expected to close before the end of the year.

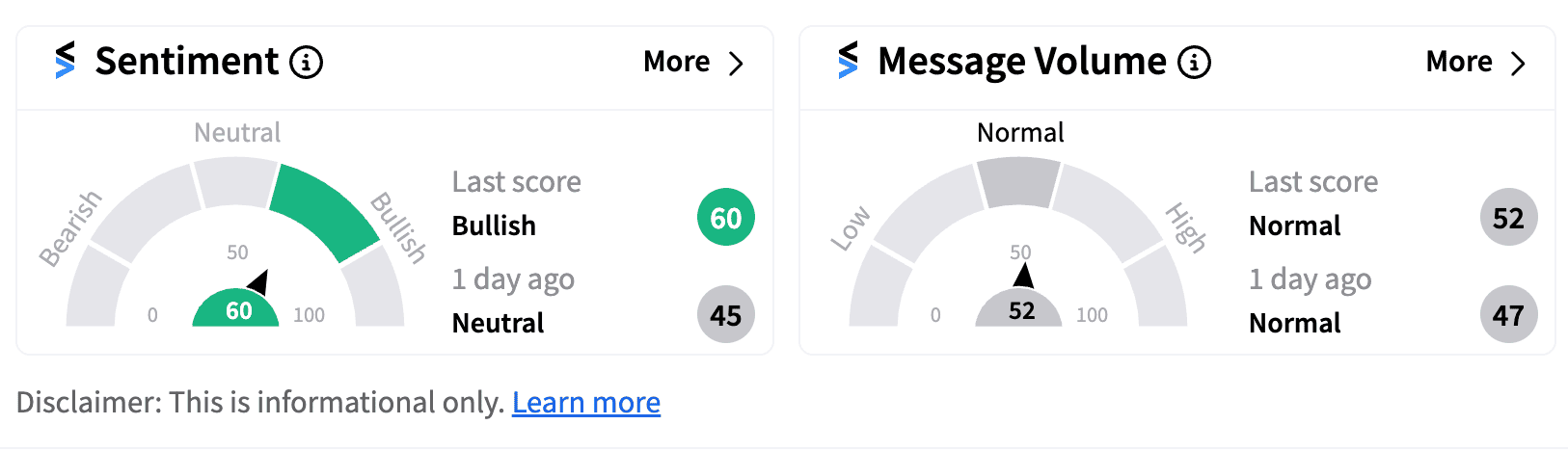

Following the announcement, retail sentiment on Stocktwits shifted into the ‘bullish’ territory (60/100) from ‘neutral’ a day ago.

Johnson & Johnson expects the transaction to dilute adjusted earnings per share (EPS) by nearly $0.24 in 2024 and approximately $0.06 in 2025.

Tim Schmid, Executive Vice President and Worldwide Chairman of Johnson & Johnson MedTech said the firm recognizes the importance of identifying more diverse and effective treatments for heart failure. “We know V-Wave well, with our relationship dating back to our original investment in the company in 2016, and we have a deep understanding of the technology and science…,” he said.

Tuesday also witnessed another positive news from the firm. The firm stated that the U.S. Food and Drug Administration (FDA) approved RYBREVANT plus LAZCLUZE for the first-line treatment of adult patients with locally advanced or metastatic non-small cell lung cancer.

Following the slew of announcements, shares of Johnson & Johnson were trading 0.6% higher on Tuesday morning. However, the stock’s performance remains unimpressive this year, having risen just a paltry 0.38%.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_new_b2128e67d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228236200_jpg_4e01019dfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_abbvie_logo_resized_2b8fc4a175.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Uber_July_8874a038f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)