Advertisement|Remove ads.

JPMorgan Stock Hits Record High Ahead Of Earnings – Barclays’ New Price Target Implies A 20% Upside

- Barclays reiterated an ‘Overweight’ rating on JPMorgan Chase.

- The new price target implies a potential 20% upside to the stock’s closing price as of Friday.

- According to the firm, JPMorgan is well-positioned to deliver sustained earnings momentum.

JPMorgan Chase & Co. (JPM) stock hit an all-time high on Monday after Barclays raised its price target on the stock to $391 from a prior $342 while reaffirming an ‘Overweight’ rating on the stock as part of its 2026 sector forecast.

The new price target implies a potential 20% upside to the stock’s closing price as of Friday. The bank is scheduled to report its fourth-quarter (Q4) earnings on January 13. Analysts expect a revenue of $45.89 billion and earnings per share (EPS) of $4.95, according to FiscalAI data.

Analyst Take

Barclays’ revisions to its large-cap financial coverage reflect confidence that the conditions driving strong bank profitability and share performance in 2025 will continue into 2026, according to TheFly.

According to the firm, JPMorgan, one of the nation’s largest financial institutions, is well-positioned to deliver sustained earnings momentum given its diversified business model.

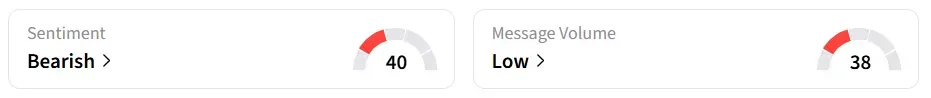

At the time of writing, JPMorgan stock pared some of the gains and traded over 3% higher. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

Special Services Launch

Additionally, JPMorgan announced the formation of a new business line, Special Advisory Services, on Monday, aimed at delivering enhanced strategic guidance across a broad spectrum of industries.

This initiative is designed to connect high-value clients with the firm’s deep pool of specialists to support complex decision-making. The group draws on specialists in areas ranging from artificial intelligence and cybersecurity to digital assets, geopolitical risk, healthcare trends, supply-chain optimization, and sustainability strategies.

“Clients are facing unprecedented change, uncertainty, and opportunity.”

- Filippo Gori, Co-Head of Global Banking, JPMorgan

“It’s more important than ever that they are aware of the breadth and depth of J.P. Morgan’s advisory capabilities,” Gori said.

JPM stock has gained over 39% in the last 12 months.

Also See: Oracle’s Risk-Reward Seems Compelling Despite Investor Concerns, Says Jefferies

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)