Advertisement|Remove ads.

Kalyan Jewellers Shares: SEBI RA Prameela Balakkala Recommends Buy On Breakout

Kalyan Jewellers is on the analysts radar as it trades just below a key breakout level, with the stock up 6% in the last one month.

The company is set to report its fourth-quarter earnings on May 8.

SEBI-registered analyst Prameela Balakkala notes that the stock recently found support at the swing low of ₹510 and is now forming a higher-low structure — often an early sign of institutional buying.

Balakkala adds that the stock is approaching falling trendline resistance around ₹527, a level it has struggled to clear in previous attempts. A decisive breakout above this line could trigger a strong rally, with swing targets placed at ₹545 and ₹560, and a positional target of ₹600.

Momentum indicators are supportive of the bullish view. The Relative Strength Index (RSI) is at 58 and trending higher; a move past 60 would indicate stronger buying momentum.

Volume patterns also reinforce the accumulation narrative, with rising volumes on green candles and decreasing selling pressure.

Importantly, Kalyan Jewellers is trading above its 20-day and 50-day EMAs, a sign that the short-term trend has turned positive. Balakkala also points to a cup-and-handle formation, a classic bullish continuation pattern. “Multiple rejections near ₹527” highlight the importance of this breakout, she notes.

Support lies at ₹510, with a stop-loss at ₹505 on a closing basis. Should bullish momentum persist, the stock could test previous supply zones and potentially reach ₹600 in the coming weeks, Balakkala highlights.

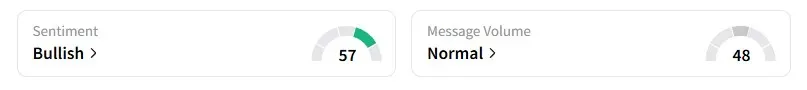

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago.

Kalyan Jewellers shares fell 32% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]c

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)