Advertisement|Remove ads.

CervoMed Gets $11 Price Target From HC Wainwright, Analyst Says Regulatory Outlook For Experimental Dementia Drug Should Be Clear Soon

H.C. Wainwright on Monday set a price target of $11 for CervoMed (CRVO) shares while keeping a ‘Neutral’ rating. The target implies a premium of nearly 5% from the stock’s closing price on Friday.

The regulatory outlook for Neflamapimod should be clarified in the near term, the analyst told investors in a research note. The firm noted CervoMed is actively preparing for discussions with the U.S. Food and Drug Administration (FDA), which management expects to take place during the fourth quarter.

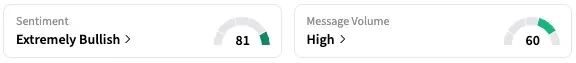

On Stocktwits, retail sentiment around CervoMed trended in the ‘extremely bullish’ territory, while message volume is at ‘extremely high’ levels.

Late in July, Cervomed said that Neflamapimod continued to slow disease progression in a type of dementia during the extension phase of its mid-stage trial. Dementia with Lewy Bodies (DLB) patients treated with Neflamapimod showed a 54% risk reduction in clinically significant worsening at week 32 of treatment, the company said.

DLB is a type of dementia characterized by the presence of Lewy bodies, which are protein clumps, in the brain. It is the second most common form of neurodegenerative dementia, following Alzheimer's disease.

The company then also confirmed that it is looking forward to initiating late-stage trials and is preparing to meet with the U.S. Food and Drug Administration in the fourth quarter to align on the trial design.

In the second quarter of 2025, CervoMed also enrolled the first patients in a mid-stage trial of Neflamapimod in patients recovering from acute stroke. It also initiated a mid-stage trial of Neflamapimod in patients with the nonfluent/agrammatic variant of primary progressive aphasia (PPA) – a subtype of frontotemporal dementia (FTD).

Neflamapimod was granted Orphan Drug designation for the treatment of FTD in November 2024. Frontotemporal dementia (FTD) is a group of brain disorders characterized by the progressive degeneration of the brain's frontal and temporal lobes, leading to changes in personality, behavior, and language.

According to data from Koyfin, all six analysts covering CervoMed rate it a ‘Buy’. The stock has an average price target of $21.50.

CRVO stock is up 334% this year but down approximately 36% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)