Advertisement|Remove ads.

KinderCare Shares Fall On Q1 Revenue Miss: Retail Bullish As 2025 Forecast Intact

KinderCare Learning (KLC) reported first-quarter revenue that missed analyst estimates on Tuesday, dragging the childcare and learning company's shares down nearly 8% in extended trading.

KinderCare manages about 1,500 centers in the United States and was listed on the New York Stock Exchange in October 2024.

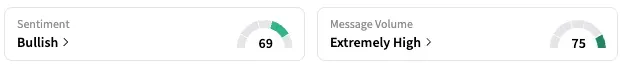

The sentiment among Stocktwits users, however, rose to 'bullish' from 'bearish' the previous day, as the company reported a larger-than-expected profit and maintained its full-year outlook.

"In a quarter with delayed enrollment decisioning across the industry, KinderCare performed well," CEO Paul Thompson said.

"As we move forward in 2025, we will continue to drive operating leverage and advance our growth initiatives to drive performance in future quarters."

In Q1, revenue rose to $668.2 million from $654.7 million a year earlier, below FactSet's analysts' estimate of $681 million.

Adjusted profit was $0.23 per share, up from $0.11 a year earlier. Analysts were expecting $0.17.

The company reaffirmed its outlook for the year, which includes adjusted EPS of $0.75 to $0.85 on revenue of $2.75 billion to $2.85 billion.

Last month, KinderCare was the subject of an investigation by The Bear Cave, a newsletter, which alleged safety violations and incidents at the company's childcare centers.

Through its close on Tuesday, KinderCare stock is down 24.4% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hut8_logo_resized_dd54f54415.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)