Advertisement|Remove ads.

KKR Q4 Earnings Top Wall Street Estimates But Revenue Declines: Retail’s Extremely Bullish

KKR & Co. (KKR) stock drew retail attention on Tuesday after its fourth-quarter earnings topped Wall Street estimates.

The company reported adjusted earnings of $1.32 per share for the three months ending Dec. 31, compared to average analysts’ estimate of $1.28 per share, according to FinChat data.

However, its fourth-quarter (Q4) revenue fell to $3.26 billion from $4.43 billion in the year-ago quarter. Street was expecting it to post $1.99 billion in revenue.

KKR’s asset management revenue fell to $1.43 billion from $1.56 billion last year.

The company’s fee-related earnings rose 25% to $843 million.

The private equity firm’s assets under management rose 15% to $638 billion at the end of the fourth quarter, compared with the previous year.

KKR said it has arrangements to raise its ownership interests by about $1.1 billion in three existing core private equity businesses: USI Insurance Services, 1-800 Contacts, and Heartland Dental.

The company said that investments would help lift its projected Strategic Holdings Operating earnings to more than $350 million by 2026, a raise of $50 million compared to prior estimates.

KKR also said it intends to raise its regular annualized dividend per share of common stock to $0.74 from $0.70.

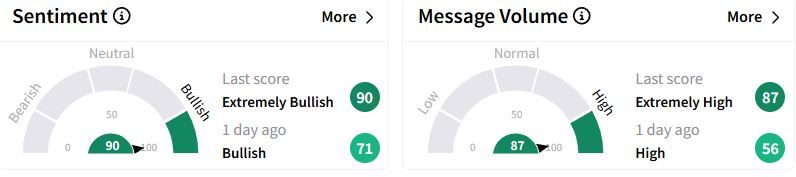

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (90/100) territory from ‘bullish’(71/100) a day ago, while retail chatter soared to ‘extremely high.’

Despite the upbeat earnings, KKR stock was down nearly 8% on Tuesday afternoon.

Over the past year, the stock has gained 70.2%.

Rival Apollo Global Management also topped quarterly profit estimates on Tuesday on record fee-related earnings.

Also See: Uber Stock Rallies Ahead Of Q4 Earnings Report: Retail Chatter Reflects Optimism

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)