Advertisement|Remove ads.

Apollo Global Management Tops Q4 Profit Estimates On Record Fee-Related Earnings: Retail Elated

Apollo Global Management (APO) drew retail chatter on Tuesday after the company topped Wall Street estimates for quarterly profit, backed by a rise in fee earnings.

The asset manager reported an adjusted net income of $2.22 per share for the fourth quarter, topping the Wall Street estimate of $1.89 per share, according to FinChat data.

However, net income declined 46.5% year-over-year (YoY) to $2.73 billion. Last year, the company received a one-time tax benefit of $1.8 billion.

Its shares were down nearly 2% on Tuesday.

The company’s fee-related earnings rose to a record $554 million from $457 million a year earlier, driven by strong growth in management fees.

Its total assets under management (AUM) rose 15% to $751 billion at the end of the fourth quarter.

The company’s inflows from asset management totaled $81 billion in 2024, including $19 billion in the fourth quarter.

Apollo aims to double its AUM to $1.5 trillion by 2029.

The company’s spread-related earnings, which denote its retirement services profits, rose 12.4% to $841 million.

Its retirement services unit Athene also posted annual inflows of $71 billion in 2024, including $14 billion in the fourth quarter, aided by continued strength in retail annuity sales and a

strong quarter of funding agreement issuance.

Apollo also raised its quarterly dividend by 10% to $2.04 per share.

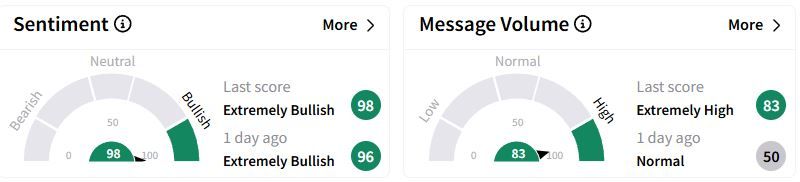

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (98/100) zone, albeit with a higher score, while retail chatter jumped to ‘extremely high.’

One user hoped the stock would pare losses and end the day higher than its last close.

Last week, rival Blackstone had also topped quarterly profit estimates.

Over the past year, Apollo Global shares have gained 58.4%.

Also See: Enterprise Products Partners Tops Q4 Estimates, Retail’s Energized

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)