Advertisement|Remove ads.

Kohl’s Stock Dives On Disappointing Outlook, But Retail’s Optimistic Post Q4 Results

Shares of Kohl’s Corp. recovered slightly in after-hours trading on Tuesday after diving nearly 24% in the regular session following the retailer’s worse-than-expected 2025 guidance, but retail sentiment was upbeat.

Kohl’s posted earnings per share (EPS) of $0.95 in the fourth quarter, surpassing estimates of $0.72.

Its revenue stood at $5.18 billion, falling 9.4% year-over-year but in line with consensus estimates of $5.18 billion. Comparable sales declined 6.7% in the fourth quarter.

Kohl CEO Ashley Buchanan said the retailer has identified key focus areas and is taking action in 2025 to reposition the company as part of a turnaround strategy. The company plans to bring curated, more balanced offerings to re-establish itself as a “leader in quality and value.”

For 2025, Kohl’s projected net sales to decline between 5% and 7%, steeper than the consensus estimate of a 1.6% decrease. Comparable sales are expected to fall between 4% and 6% during the year.

Diluted EPS is expected to range between $0.10 and $0.60.

"Kohl's is built on a strong foundation that includes operating more than 1,100 conveniently located stores nationwide, serving over 60 million customers, with 30 million of those customers being Kohl's Loyalty Members,” said Buchanan.

Kohl's also reduced its quarterly cash dividend to $0.12 per share, payable on Apr. 2 to shareholders of record at the close of business on Mar. 21. The dividend has been reduced from $0.50 from the previous quarter.

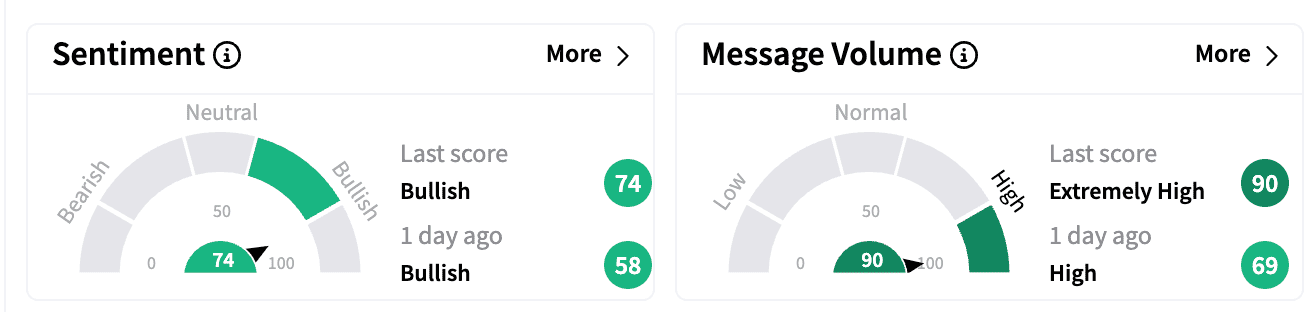

Despite Tuesday’s steep decline, sentiment on Stocktwits inched up to ‘bullish’ territory. Message volume climbed to ‘extremely high’ levels.

One bullish watcher was awaiting a recovery along with the market.

Another watcher suggested the company should consider going private.

Last month, Kohl’s said it has cut 10% of its corporate workforce to boost profitability. The news came shortly after the company also disclosed plans to close 27 of its “underperforming stores” in April.

Kohl’s stock is down 34% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)