Advertisement|Remove ads.

Labcorp Raises Full Year Guidance After Q2 Earnings Beat Wall Street Expectations: Retail Sees Rally To $330

Laboratory services provider Labcorp (LH) on Thursday raised its full-year guidance after its second-quarter earnings beat Wall Street expectations.

The company now expects full-year adjusted earnings per share to be between $16.05 and $16.50, up from its previous guidance of $15.70 to $16.40, in line with an analyst estimate of $16.10.

It also expects free cash flow of $1.13 billion to $1.28 billion, marking an increase from its old guidance of $1.10 billion to $1.25 billion. Labcorp also hiked its revenue growth estimates for its diagnostic laboratories and biopharma laboratory services segments.

A weaker dollar primarily drove the lift in guidance in addition to the strength of its business, the company said. The new guidance assumes foreign exchange rates effective as of June 30, 2025, for the remainder of the year.

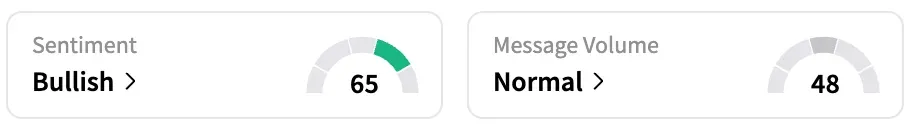

On Stocktwits, retail sentiment around LH jumped from ‘neutral’ to ‘bullish’ over the past 24 hours while message volume improved from ‘low’ to ‘normal’ levels. Shares of the company traded 6% higher on Thursday afternoon at the time of writing.

A Stocktwits user expressed optimism about the stock’s potential to rally toward $330.

For the second quarter, the company reported total revenue of $3.53 billion, representing a 9.5% growth, driven by an increase in revenue from its diagnostics laboratories segment. Q2 revenue beat an analyst estimate of $3.49 billion, according to data from Fiscal AI.

Adjusted earnings per share came in at $4.35, up from $3.94 in the corresponding quarter of 2024, and above an expected $4.16.

At the end of the quarter, Labcorp's cash and cash equivalents balance was $0.65 billion, and total debt was $5.58 billion.

LH stock is up 16% this year and by over 27% over the past 12 months.

Read Next: Mullen Automotive Name Change To Be Effective July 28, But Retail’s Not Optimistic Yet

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)