Advertisement|Remove ads.

LAES Stock Trades Below 200-DMA For First Time In Over 2 Months

- Before Friday, LAES stock traded below its 200-DMA around mid-September.

- The stock is on track to close in the red for a ninth time in the last 10 sessions.

- On Tuesday, LAES reaffirmed its full-year 2025 revenue guidance and announced that it expects stronger growth in 2026

Shares of SEALSQ Corp. (LAES) fell over 6% on Friday, dropping below its 200-day moving average (200-DMA) for the first time in over two months.

According to TradingView data, the stock last traded below its 200-DMA around mid-September. LAES stock has been on a downtrend over the last couple of weeks, and is on track to close in the red for a ninth time in 10 sessions. It has recorded a 46% decline in value during this period.

Growth Expectations

On Tuesday, LAES reaffirmed its full-year 2025 revenue guidance and announced that it expects stronger growth in 2026, supported by rising demand and its acquisition of IC'Alps, an integrated circuits developer.

For 2025, SEALSQ expects revenue of $17.5 million to $20 million, representing a 59% to 82% growth over last year. In 2026, the company projects a further 50% to 100% increase in revenue.

The firm also reported preliminary revenue of $9.9 million for the first nine months of 2025, up 41% from the year-earlier period.

Earlier on Friday, the company partnered with Quobly to explore how secure semiconductor designs can work with scalable quantum systems.

How Did Stocktwits Users React?

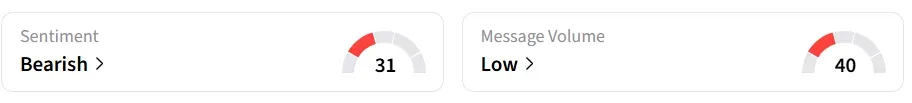

Retail sentiment for LAES on Stocktwits has remained in the ‘bearish’ territory for the past 24 hours.

A Stocktwits user recommended buying the dip.

Another user sounded positive on the AI and quantum sectors.

Year-to-date, the stock has shed nearly 50%.

Also See: Bitcoin ETFs Hit Record Monthly Outflows In November – Average Investor Now in the Red, Says Analyst

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)