Advertisement|Remove ads.

Laurus Labs Could See Profit Booking After Overbought Rally: SEBI RA Anupam Bajpai

After rallying for eleven consecutive sessions, Laurus Labs could finally be seeing a short pullback. The stock hit fresh record highs and clocked over 20% gains in a rally that extended from June 20 to July 4.

At the time of writing, Laurus Labs stock was down 0.3% to ₹773.50.

According to SEBI-registered analyst Anupam Bajpai, technical indicators now suggest that the Laurus Labs stock may be entering overbought territory, potentially leading to a consolidation phase.

Between July 1 and 4, daily candlesticks consistently formed outside the upper Bollinger Band, indicating an overextended move, he observed. This price action suggests the stock may have advanced too quickly, signaling a potential pullback or period of consolidation ahead.

The Relative Strength Index (RSI) has surged to 83, well above the overbought threshold of 70, signaling an increased risk of a near-term correction, the analyst said.

The stock could pull back to the 20-day moving average, which has served as dynamic support in past corrections. This level offers a healthier and more sustainable approach to taking on positions, Bajpai added.

The company reported strong fourth quarter results, with net profit surging to ₹233.6 crore from ₹75.6 crore in the same period last year.

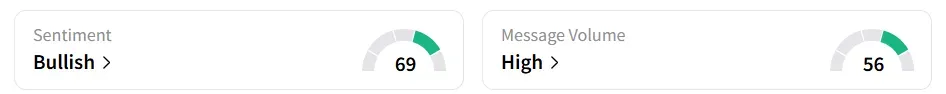

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a week earlier amid ‘high’ message volumes.

Year-to-date, the stock has gained more than a quarter of its total value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)