Advertisement|Remove ads.

Laurus Labs Entering Multi-Year Growth Cycle After 875% Profit Surge; SFP Research Sees Over 10% Upside Potential

- The Hyderabad-based pharma player posted stellar Q2, driven by strong CDMO and generics growth.

- Analysts maintain a bullish outlook despite valuation concerns.

- SFP Research set a short-term target of ₹1,000–₹1,030.

Laurus Labs shares fell 3% in early trade on Friday, a day after the company reported a strong September quarter (Q2 FY26) earnings performance.

Revenue of ₹1,653 crore marked a 35% YoY growth, primarily driven by 53% growth in the CDMO segment (₹518 crore) and 28% growth in Generics (₹1,135 crore). Net profit of ₹195 crore represents an 875% YoY jump in Q2.

SEBI-registered analyst SFP Research recommends ‘Buy’ for medium to long-term and ‘Hold’ for short-term, with a target price of ₹1,000-1,030 (6-month horizon). Laurus Labs is entering a strong growth cycle driven by its transformational CDMO business, which has emerged as the key earnings driver with sustained margin expansion.

Laurus’ positioning in the rapidly growing Indian CDMO market ($7.9 billion to $15.4 billion by 2033), coupled with the global ‘China Plus One’ tailwind, provides a multi-year growth runway, according to SFP Research.

Laurus Labs: Technical Outlook

Laurus Labs stock successfully broke through resistance at the ₹920 levels and is consolidating near all-time highs. The analysts identified immediate support at ₹880-900, strong support at ₹840-860, and major support at ₹800-820. On the upside, immediate resistance is seen at ₹944 (52-week high), followed by ₹950-1000.

A decisive break above ₹950 can propel the stock toward ₹1,000-1,030 levels. They added that the uptrend remains intact as long as the stock trades above ₹840.

What’s Driving The Bullish Call?

Laurus Labs reported an exceptional 875% profit growth, demonstrating an operational turnaround. The CDMO business delivered 53% growth with robust pipeline of 110+ projects.

The analysts highlighted that the company’s investments in ADC, biologics, gene therapy position for future growth. Additionally, it enjoys strong institutional backing with 26% FII holding and increasing MF participation.

Valuation Concerns

SFP raised concerns about its stretched valuation at 100x PE versus fair value of 46x PE. However, given the strong momentum, superior execution, and margin expansion, they believe that the stock can sustain premium multiples in the near term.

What Should Traders Do?

For existing investors, they recommend holding positions with a stop-loss at ₹840-850. New investors should consider accumulating in 5-10% corrections toward the ₹850-880 support zones for better risk-reward.

What Is The Retail Mood On Stocktwits?

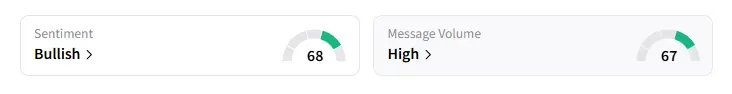

Data on Stocktwits showed that retail sentiment turned ‘bullish’ a day ago, following strong Q2 earnings performance amid ‘high’ message volumes.

Laurus Labs shares have surged 50% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)