Advertisement|Remove ads.

Li Auto Analyst Says Profitability Halo Cracks After Q3 Print, Trims Target And Warns Of Tough Road Into 2026

- The company’s Q4 delivery and revenue guidance came in below expectations, signaling softer demand and a weaker mix.

- Macquarie cut FY26–FY27 volume estimates and lowered its target price by 19%.

- The brokerage warned of margin pressure into early 2026 and rising competition for Li Auto’s extended-range lineup.

After Li Auto posted its first adjusted quarterly loss in three years, a Macquarie analyst said the new-energy vehicle maker’s credentials as the profitability leader in China have weakened.

Despite weak earnings, Li Auto’s shares rose 1.7% in early Asian trading on Thursday, while its U.S.-listed stock gained 0.6% at Wednesday’s close and added a further 0.1% after hours.

Macquarie Says Profitability Halo Is Gone

Macquarie said the Q3 net loss “takes away belief” in Li Auto as a consistently profitable EV maker. It noted that even though vehicle margins were 19.8% excluding the MEGA recall and broadly in line with expectations, the overall quarter showed a break from the company’s earlier profitability track record. The brokerage also highlighted continued battery supply challenges that are unlikely to be resolved heading into the first quarter (Q1) of 2026, along with low visibility on demand.

Macquarie added that weakness across the existing L-series extended-range models has persisted, and the company has not provided specifics on how the upcoming L-series refresh will regain share in a market facing new extended-range entrants in 2026.

Macquarie Slashes FY26–FY27 Outlook

Macquarie cut its FY26 volume estimate by 20% and reduced its FY27 forecast by 14% following Li Auto’s lower fourth quarter (Q4) guidance. It lowered its 12-month target price by 19% to HK$66 ($17) and maintained its ‘Underperform’ rating. The brokerage’s updated valuation is based on 18x FY26 earnings and implies a 0.9x price-to-sales multiple, which it said is in line with Li Auto’s two-year historical average.

Macquarie said Li Auto’s Q4 delivery target of 100,000 to 110,000 units falls 23% below Bloomberg consensus at the midpoint. Revenue guidance of 27.9 billion yuan is 25% below expectations and suggests lower revenue per unit in Q4. The company also guided vehicle margins lower to 16%–17% amid a weaker mix.

Macquarie Highlights Positives, Headwinds

The brokerage noted two positives from the quarter, including vehicle margins excluding the MEGA recall, and the company’s plan for a major “entrepreneurial” overhaul in Q4 that could drive a shift in product strategy.

However, Macquarie said sequential vehicle-margin pressure is likely to continue into Q1 of 2026 alongside increased cash burn. It warned that hopes for a market-share inflection from refreshed L-series models may be challenged by intensifying competition from newer players in the extended-range vehicle space. It also said Li Auto has yet to show a competitive position in battery-electric vehicles.

Macquarie added that while the company still retains the highest sales volume among premium new-energy vehicle peers, that lead is increasingly under threat.

Stocktwits Bulls And Bears Clash On Li Auto’s Path

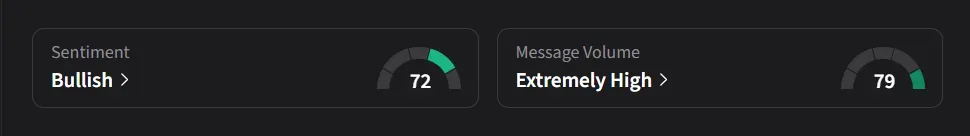

On Stocktwits, retail sentiment for Li Auto was ‘bullish’ amid ‘extremely high’ message volume.

One user said, “anything bought here will be a nice return in a year. We’ve seen this bounce from these levels all the way to $35+ on many occasions. Will top up this week.”

Another user said the stock “will climb to $20 and then dump to $15.”

Li Auto’s U.S.-listed stock has declined 23% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)