Advertisement|Remove ads.

Liberty Energy Rises After Q1 Profit Beat, Projects Sequential Revenue Growth: Retail’s Still Divided

Liberty Energy (LBRT) stock gained 7.4% in extended trading on Wednesday after the U.S. oilfield services firm beat Wall Street’s estimates for first-quarter earnings.

The company reported adjusted net income of $0.04 per share for the first quarter, topping a Wall Street estimate of $0.03, according to FinChat data.

The Denver-based company also reported revenue of $977 million for the quarter ended March 31, compared to analysts’ expectations of $948.5 million.

Its net income fell to $20.1 million, or $0.12 per share, for the first quarter, compared with $81.9 million, or $0.48 per share, a year earlier.

“Our early year results demonstrate a positive rebound from the fourth quarter of 2024, a trend that has continued into the second quarter,” CEO Ron Gusek said.

North American oil and gas producers have taken a disciplined approach to production amid oil price volatility.

“While North American producers have not yet meaningfully changed development plans, we expect our customers to assess a range of scenarios in anticipation of commodity price pressure,” Gusek said.

The company said gas producers could benefit from potentially lower associated gas production in oily basins.

Gusek said Liberty expects sequential growth in revenue and profitability in the second quarter from higher utilization.

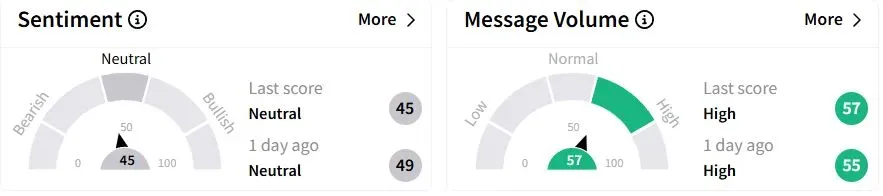

Retail sentiment on Stocktwits was in the ‘neutral’(45/100) territory, albeit with a lower score than a day ago, while retail chatter was ‘high.’

Liberty shares have fallen 43.7% year-to-date (YTD).

Larger rival SLB is scheduled to report its results on April 25.

Also See: Ford, Nissan Adjust Strategies In Response To Trump Auto Tariffs: Retail Sentiment Mixed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Service_Now_logo_jpg_c0da5348e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_doordash_jpg_6a0ffd4b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)