Advertisement|Remove ads.

LIDR Stock Sees Explosive Retail Chatter After Shares Surge Over 5%: Here Are The Updates

Lidar technology provider AEye Inc. (LIDR) shares dipped over 7% on Monday after the company said it has expanded its ongoing at-the-market equity offering, increasing the total authorized sale of shares to $75 million.

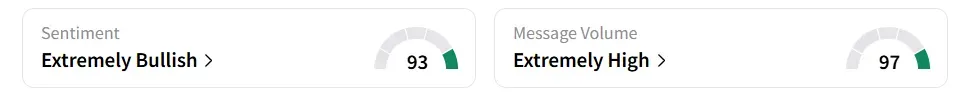

On Stocktwits, retail sentiment around AEye remained in ‘extremely bullish’ (93/100) territory amid ‘extremely high’ (97/100) message volume levels.

The stock experienced a 154% increase in user message count in the last 24 hours. AEye stock tarded over 1% on Monday morning.

The news sparked mixed reactions from users. A Stocktwits user noted that, despite the recent offering, the market cap still appears small.

Another user expected larger offerings in the future.

As of late July, AEye's public float, shares held by investors not affiliated with the company, stood at over $129 million in market value.

The increase in offering capacity provides the lidar technology firm with more financial flexibility as it continues to develop advanced sensing solutions.

On Monday, AEye said it has begun field deployment of OPTIS, a customizable, AI-powered lidar platform enabling real-time 3D perception, targeting smart infrastructure and mobility markets.

On July 25, the company announced that its product, Apollo, had been integrated into Nvidia Corp.'s (NVDA) DRIVE AGX platform, which drove Stocktwits retail sentiment to a four-year high.

AEye stock has gained over 249% year-to-date and over 183% in the last 12 months.

Also See: PayPal Taps Into $3T Crypto Market With New Merchant Payment Option: Retail Says It’s A Win-Win

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2265300941_jpg_bae5290201.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_TMC_CEO_c963fa0b0f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Ui_Path_resized_210dc0332c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_006db9f466.webp)