Advertisement|Remove ads.

PayPal Taps Into $3T Crypto Market With New Merchant Payment Option: Retail Says It’s A Win-Win

PayPal Holdings Inc. (PYPL) is stepping up its efforts to modernize cross-border commerce by unveiling a new crypto-powered solution designed to reduce international transaction costs and simplify global payments for merchants.

Dubbed “Pay with Crypto,” the service enables U.S. merchants to accept payments in over 100 cryptocurrencies via major wallets, including Coinbase and MetaMask.

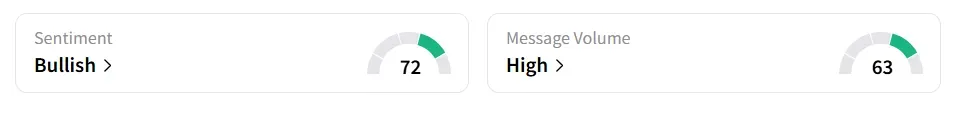

On Stocktwits, retail sentiment toward PayPal remained in ‘bullish’ (72/100) territory amid ‘high’ (63/100) message volume levels.

A bullish user said small businesses and consumers will benefit from the move.

The initiative is designed to slash transaction fees by as much as 90% compared to conventional credit card processing.

Following the launch, PayPal stock inched 0.3% higher on Monday, after the morning bell.

Pay with Crypto opens the door for merchants to engage with the expanding global cryptocurrency market, which now exceeds $3 trillion in value, according to the company.

The platform offers a low, fixed transaction fee of 0.99%, offering a much cheaper alternative to conventional international payment methods.

Merchants using the service can now accept cryptocurrency, settle payments quickly, and even earn rewards for holding PayPal’s stablecoin, PYUSD, on the platform.

"Imagine a shopper in Guatemala buying a special gift from a merchant in Oklahoma City. Using PayPal's open platform, the business can accept crypto for payments, increase their profit margins, pay lower transaction fees, get near instant access to proceeds, and grow funds stored as PYUSD at 4% when held on PayPal,” said President and CEO Alex Chriss.

As PayPal accelerates its involvement in blockchain-based finance, it is contributing to the larger trend of increasing institutional adoption of crypto for mainstream business functions.

PayPal stock has lost over 8% year-to-date and gained over 32% in the past 12 months.

Also See: This Chipmaker Got A Price Target Hike From UBS Ahead Of Q2 Earnings: Here’s Why Retail’s Excited

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)