Advertisement|Remove ads.

Eli Lilly Remains JPMorgan's Top Biopharma Pick For 2025, But Gilead And Bristol Myers Also Gain Praise — Is Retail On Board?

JPMorgan is sticking with Eli Lilly (LLY) as its top biopharma pick for 2025, while also highlighting Gilead Sciences (GILD) and Bristol Myers Squibb (BMY) as stocks with potential upside, according to a CNBC report.

Analyst Chris Scott remains bullish on Lilly's weight-loss drug franchise, expecting continued growth from blockbuster weight-loss drugs Mounjaro and Zepbound, and the anticipated mid-2026 launch of its experimental obesity pill orforglipron.

However, recent sales misses for Mounjaro and Zepbound have raised concerns, as have Medicare coverage uncertainties for obesity drugs.

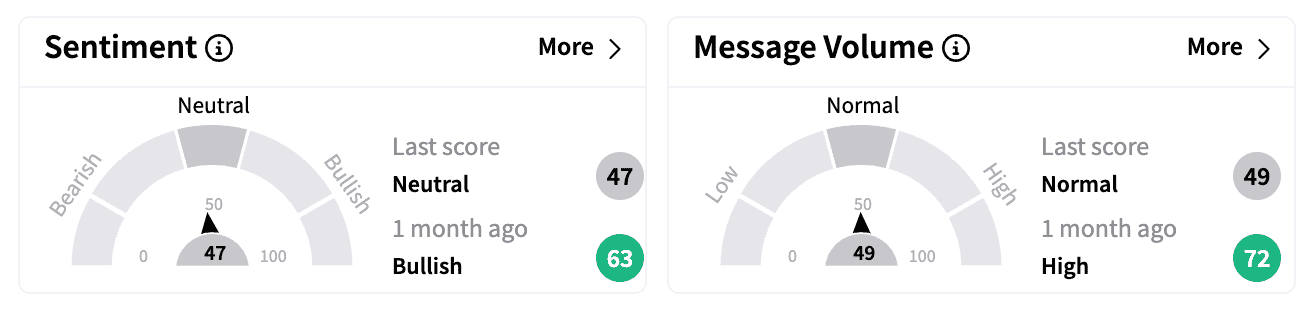

On Stocktwits, retail sentiment for LLY has softened from 'bullish' to 'neutral' over the past month, with message volume down 15%.

Traders are weighing competition from rival weight-loss treatments and possible regulatory risks, especially with Robert F. Kennedy Jr. taking over as Secretary of Health and Human Services. He has previously made controversial statements about weight-loss medications, raising concerns about future policy direction.

Despite delivering strong quarterly earnings, BMY stock has struggled after issuing disappointing 2025 guidance. JPMorgan sees the dip as driven more by legacy product declines and currency headwinds than fundamental weaknesses.

The firm believes BMY has potential upside from accelerated adoption of Cobenfy (its schizophrenia treatment), new data on Alzheimer's and schizophrenia drugs, and a $2 billion cost-cutting initiative.

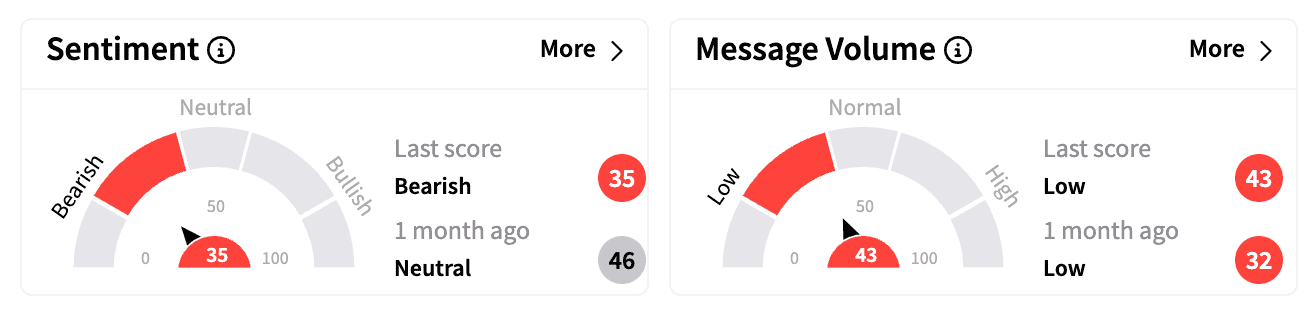

Retail traders, however, have turned 'bearish' on BMY ahead of Friday's session, compared with 'neutral' a month ago, with Stocktwits message volume rising 14%.

The stock is down 2% year-to-date and trades about 10% below analysts' average price target of $61.34.

JPMorgan sees Gilead as well-positioned due to its strong HIV drug portfolio and disciplined expense management.

However, the company expects an adverse revenue impact of $1.1 billion in 2025 due to Medicare's prescription drug plan changes, which could impact its HIV business.

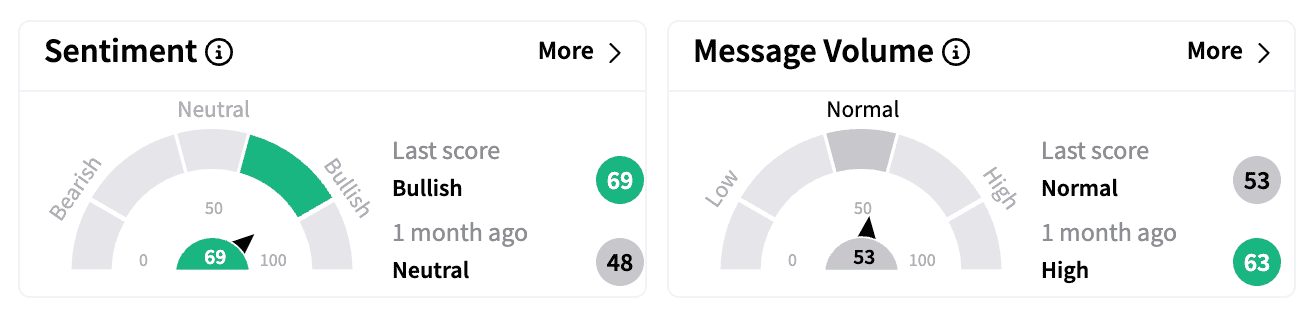

On Stocktwits, retail sentiment for GILD flipped from 'neutral' a month ago to 'bullish,' with message volume surging 75% ahead of Friday's session.

The stock has risen over 18% in 2025 and is trading at about 3% above analysts' average price target of $107.03.

Meanwhile, JPMorgan categorized Regeneron (REGN) and Merck (MRK) as "out of favor" names, suggesting investors are focusing on stronger core assets and upcoming launches rather than uncertainty.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)