Advertisement|Remove ads.

We Asked Retail Traders About Eli Lilly’s Biggest Post-Q4 Risk — Most Say It’s The Weight-Loss Drug Wars

Shares of Eli Lilly finished Thursday 3% higher despite an earnings report that showed sales of its blockbuster GLP-1 weight-loss drugs, Zepbound and Mounjaro, missed estimates for the second consecutive quarter.

However, strong sales of older diabetes treatments helped offset the shortfall.

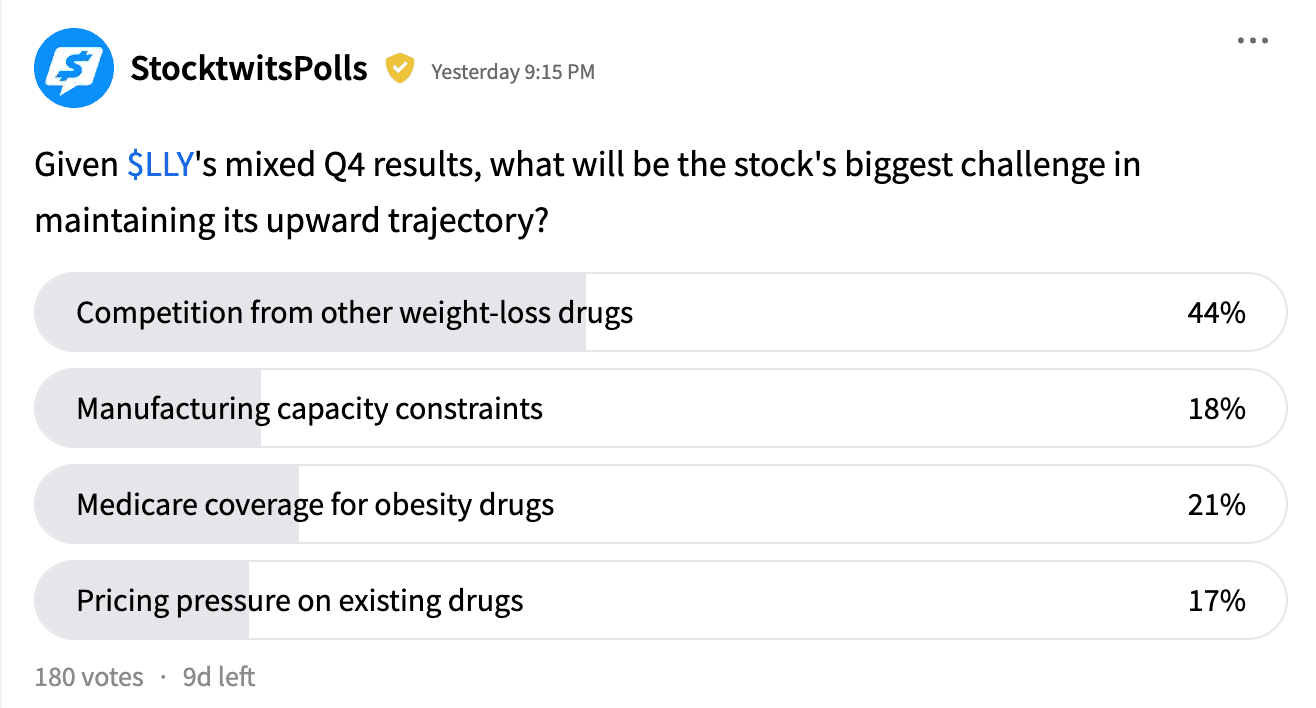

A Stocktwits poll of retail investors found that 44% view competition from rival weight-loss drugs as the biggest risk to Lilly’s stock following fourth-quarter (Q4) earnings, while 21% cite Medicare coverage for obesity drugs as a key challenge.

Lilly’s fiercest competitor in the obesity market is Novo Nordisk, whose semaglutide-based treatments, Ozempic and Wegovy, dominate the space.

But Lilly scored a major win in December after a clinical trial it sponsored showed that Zepbound outperformed Wegovy, lifting investor sentiment.

Novo’s stock, meanwhile, is still recovering from a big blow. In December, results from a Phase 3 trial of its experimental obesity drug, CagriSema, fell short of the benchmark it had hoped for.

Lilly also faces threats from smaller players such as Hims & Hers, which recently entered the weight-loss space, selling compounded versions of drugs like Wegovy and Ozempic.

Both Lilly and Novo have taken legal action against compounding businesses, citing safety concerns and lack of regulatory oversight. However, U.S. law allows telehealth platforms to manufacture these copycat drugs only when the branded originals are in short supply.

Further competition is looming from pureplay biotech firms such as Amgen and Viking Therapeutics, which are developing promising obesity drug candidates.

Meanwhile, Lilly has announced plans to report late-stage data for its next-generation obesity drug, retatrutide, later this year.

Another key issue for Lilly is Medicare coverage of obesity treatments. Its CFO is reportedly confident that the Trump administration may support expanding coverage.

Retail traders are also closely monitoring manufacturing capacity constraints. Lilly said Thursday that it expects to manufacture at least 1.6 times more incretin doses in the first half of 2025 compared to a year ago.

Finally, investors worried about pricing pressure on existing drugs are eyeing the Inflation Reduction Act’s Medicare price negotiations, set to take effect in 2027.

While Lilly’s obesity drugs have not yet been listed for negotiations, Novo’s offerings have — and that has raised concerns about potential ripple effects. Lilly and its peers plan to urge the Trump administration to pause these negotiations and revise certain IRA policies.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tim_cook_OG_jpg_08b852f801.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_etoro_logo_resized_jpg_e33db568c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamieson_greer_jpg_e66ba6dd7a.webp)