Advertisement|Remove ads.

Gilead Wins Price-Target Boosts After Solid Q4, Retail Brushes Off Medicare Reform Hit To HIV Drugs

Shares of Gilead Sciences Inc. surged over 4% in premarket trading on Wednesday following a solid fourth-quarter earnings report, with multiple analysts raising their price targets.

Morgan Stanley raised its price target to $123 from $113, maintaining an 'Overweight' rating, citing the potential for upward estimate revisions and further multiple expansion as the company advances its next-generation HIV pipeline.

Wells Fargo also increased its target to $120 from $105, highlighting Gilead's resilience in its 2025 guidance despite headwinds from Medicare reforms and foreign exchange impacts.

Piper Sandler raised its target to $110 from $105, retaining its 'Overweight' rating, while Baird bumped its target to $100 from $95 but kept a 'Neutral' outlook.

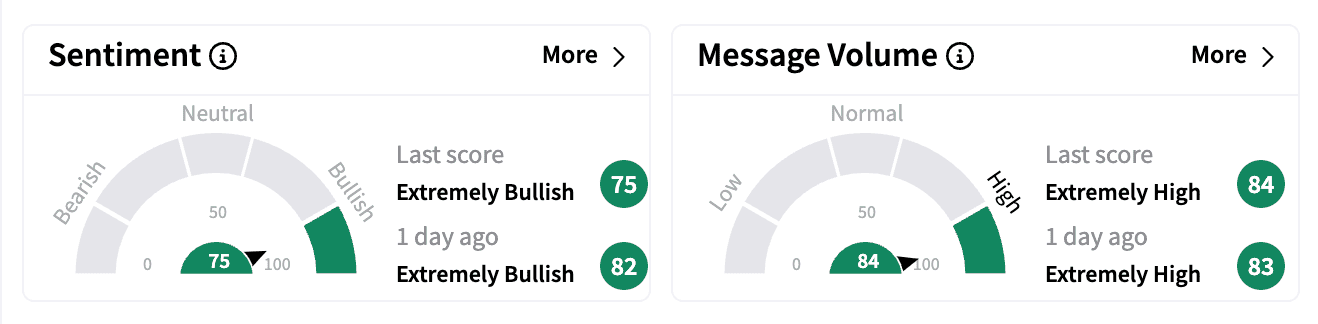

The retail sentiment on Stocktwits was overwhelmingly positive, with a nearly 1,900% jump in message volume on Tuesday when Gilead released Q4 earnings.

Many retail traders expressed optimism, with one user predicting the stock would head to $120, where it "belongs," and another hoping for an all-time high breakout soon.

Gilead's fourth-quarter revenue came in at $7.6 billion, surpassing the consensus of $7.2 billion. Adjusted earnings per share (EPS) were $1.90, above the estimate of $1.74.

For 2025, the company provided sales guidance between $28.2 billion and $28.6 billion, roughly aligning with expectations, and projected non-adjusted EPS between $7.70 and $8.10, ahead of the consensus of $7.61.

CFO Andrew Dickinson attributed the earnings beat to strong demand-led volume growth across key segments such as HIV, oncology, and liver disease.

However, he acknowledged that changes to Medicare's prescription drug plan, which include a $2,000 out-of-pocket spending cap, would cost Gilead $1.1 billion in lost revenue in 2025, which could weigh on the growth of its HIV business.

The company's stock is up nearly 31% over the past year and is currently trading around 5% below the average Wall Street price target of $101.24.

Gilead's stock hit an intraday high of $122.40 in 2015 and has since dropped more than 21% from that level.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)