Advertisement|Remove ads.

Lowe's, Home Depot Results This Week Will Give Clear Picture Of Consumer Sentiment: Retail Upbeat

Quarterly reports from Lowe's Companies (LOW) and Home Depot (HD) this week will offer a clearer picture of how consumers are responding to the macroeconomic challenges sparked by President Donald Trump's trade policies.

The two companies dominate the home improvement retail space, a category where consumer spending typically rises during periods of strong economic confidence. Demand in this sector also serves as a key barometer for the broader housing market.

Lowe's reports results on Wednesday, and Home Depot will report on Thursday.

The macroeconomic markers are, at best, mixed.

Last week, Moody's downgraded the U.S. sovereign credit rating, weakening investor confidence and putting pressure on markets and bond prices.

JPMorgan on Monday lowered the probability of a U.S. recession occurring in 2025 to below 50%, down from 60% previously, citing the latest trade policy developments, including the temporary tariff reduction between the U.S. and China.

U.S. retail sales rose just 0.1% month over month in April, a sharp deceleration from March's revised 1.7% increase.

According to Koyfin data, Lowe's is expected to report a nearly 2% drop in sales to $20.97 billion and a 6% drop in adjusted profit to $2.88 per share.

Lowe's top line has shrunk in the last two years, and analysts expect it to return to growth in the current fiscal year ending January 2026.

Home Depot sales are expected to rise 7.8% to $39.25 billion, while adjusted profit would be down 1.1% to $3.59 per share.

In a recent investor note, RBC said Home Depot could slightly beat profit estimates, and Lowe's may meet Q1 targets but could lower its outlook.

According to a Reuters report, debit and credit card purchase data from Affinity Solutions showed that April sales at Lowe's tumbled nearly 3% year over year, compared to 6.6% growth in March.

Home Depot sales rose 0.7% in April, after a 4.2% rise in March.

On Monday, Evercore ISI added Home Depot to its "Outperform Tactical and Action Positioning Call List," a curated selection of stocks the firm believes are poised for near-term outperformance.

The brokerage said maintaining guidance and signaling improving trends could lift Home Depot's shares back toward the $400 level.

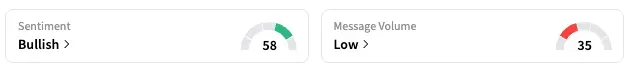

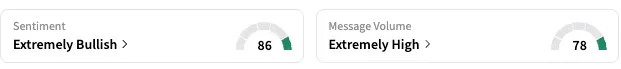

On Stocktwits, the retail sentiment for Lowe's jumped to 'bullish' from 'neutral, while Home Depot’s rose to 'extremely bullish' from 'bullish.'

Lowe's shares are down 5% this year, while Home Depot shares are down 2.5%. That compares to a 1.4% gain in the benchmark S&P 500 (SPX) during the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)