Advertisement|Remove ads.

L&T Finance Breakout Alert: SEBI RA Mayank Singh Chandel Sees Fresh Upside, Sets Two-Stage Buying Strategy

L&T Finance’s breakout is supported by robust technical and fundamental indicators, said SEBI-registered analyst Mayank Singh Chandel.

The stock recently breached past its key resistance zone of ₹194.25, confirming a well-formed rounding bottom pattern that had been developing since late 2024 into early 2025, Chandel added.

At the time of writing, L&T Finance shares were trading marginally higher at ₹200.88.

The stock is also comfortably trading above its 50-day exponential moving average (EMA) of ₹176.36, further validating the positive trend, the analyst said. The stock is currently 6.5% off its record high of ₹213.85, indicating room for further upside.

Chandel recommends a two-slot buying strategy for the stock.

First Entry: Initiate a position at current levels, as the breakout has been confirmed and the price action is showing strength.

Second Entry: Consider adding more if the stock breaks above its all-time high of ₹213.85, a potential trigger for the next leg of the rally. He recommends setting a stop loss below ₹180.

From a fundamental perspective, the company has reported strong Q4 results with a 15% year-on-year growth in net profit at ₹636.2 crore, while net interest income (NII) also grew by 3.8% to ₹2,423.2 crore.

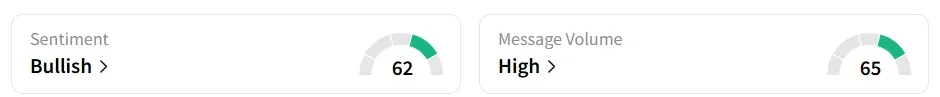

Retail sentiment on Stocktwits for L&T Finance flipped to ‘bullish’ from ‘bearish’ a day earlier.

The stock has gained nearly 48% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)