Advertisement|Remove ads.

LTIMindtree Shares Rally On Mega AI Contract: SEBI RA Priyank Sharma Pencils ₹4,483 As Key Support Level

LTIMindtree shares gained for a second straight session after the company announced its largest-ever contract — a $450 million multi-year deal centered around artificial intelligence with a global agribusiness giant.

The announcement marked a pivotal moment for the company, reinforcing investor confidence in its digital capabilities and long-term growth outlook.

The stock jumped nearly 7% on the day of the announcement and extended its gains the following session, reversing some of its year-to-date losses.

SEBI-registered analyst Priyank Sharma observed that the stock had been moving in a broad sideways range between ₹3,800 and ₹6,450 since March 2022.

However, it recently attempted to break out of this range, with ₹4,483 emerging as a critical support level.

Sharma highlighted this level as a base for potential upside, noting that the stock had also surpassed its March 2024 weekly high — shifting its short-term structure to bullish.

Resistance levels were pegged at ₹5,650 and ₹6,450, while a weekly close below ₹4,200 would negate the bullish view.

Sharma concluded that the overall technical pattern supported a positive bias as long as the ₹4,483 support held firm.

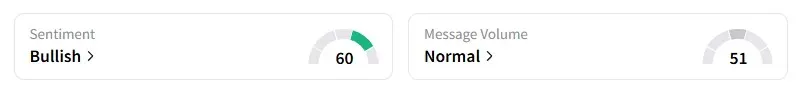

Retail sentiment on Stocktwits for this counter has turned ‘bullish’ from ‘bearish’ a week ago.

LTIMindtree shares have fallen 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)