Advertisement|Remove ads.

Luminar Stock Climbs Pre-Market As Q3 Print Looms, But Retail Holds Back Enthusiasm

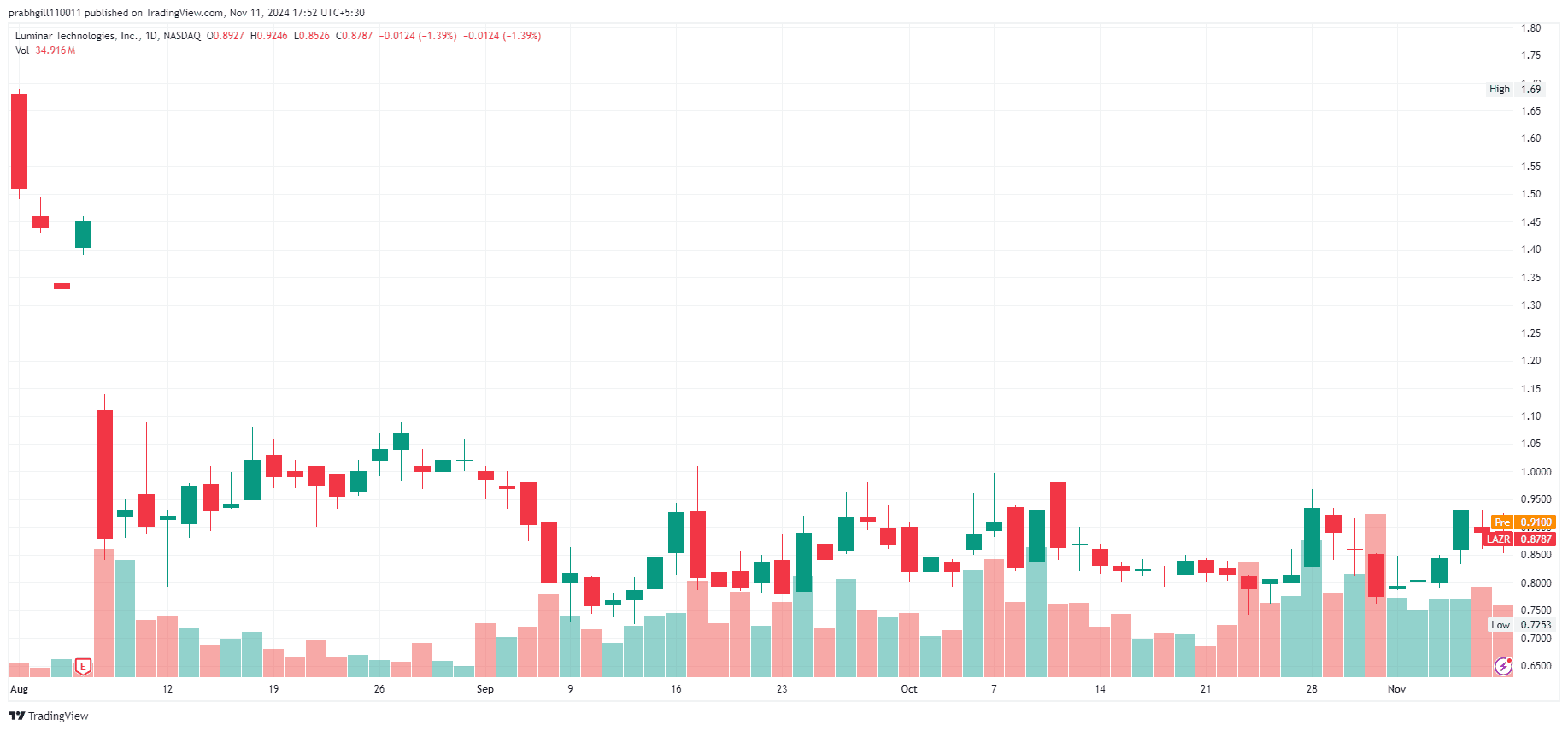

Shares of Luminar Technologies Inc. ($LAZR) rose nearly 5% in pre-market trading on Monday, as the lidar company prepares to release third-quarter earnings after the closing bell.

Analysts expect Luminar to post a loss of $0.15 per share on revenue of $17.7 million.

The company specializes in lidar, a laser-based technology increasingly adopted by automakers to enhance vehicle safety and support the advancement of autonomous driving.

Tesla ($TSLA), one of Luminar's major clients, accounts for over 10% of its revenue, with Tesla using lidar on some test vehicles since at least 2021.

Luminar also supplies its lidar tech for Volvo’s EX90 electric vehicle, although slower-than-anticipated production from Volvo ($VLVLY) ($VLVOF) has led Luminar to adjust its financial targets last quarter.

Luminar revised its guidance to achieve sales of $35 million per quarter by 2025—a goal previously targeted for the end of 2024.

This delay, tied to Volvo's production pace, has also pushed back Luminar's profitability timeline.

While the company had hoped to turn a profit by late 2025, it now anticipates a longer path to profitability but hasn’t provided a revised target.

Following a challenging second quarter in which Luminar missed earnings expectations for a fourth straight quarter and lowered guidance despite debt reduction, the stock dropped nearly 40% and has since traded in a lower range.

Due to the recent drastic fall in share price, Luminar was notified by Nasdaq on Oct. 21 that it no longer meets the minimum bid requirement for continued listing.

Consequently, stockholders approved a reverse stock split at a ratio between 1:5 and 1:20 on Oct. 30. The board of directors can execute the split any time before Dec. 31, providing flexibility to restore compliance if necessary.

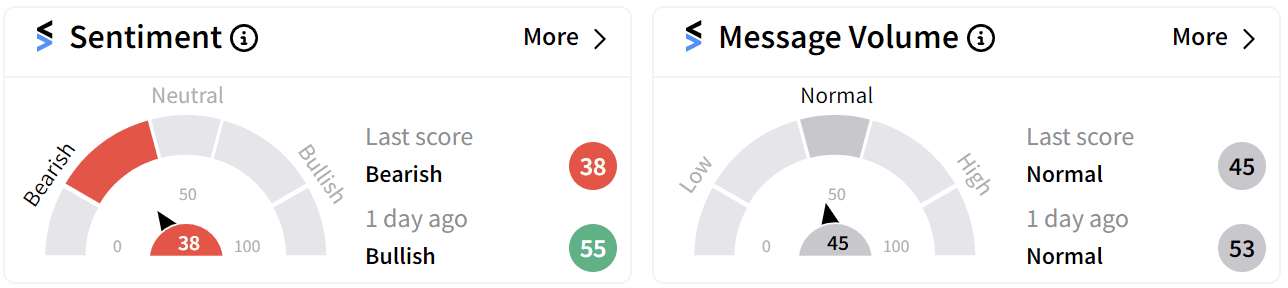

Retail sentiment on Stocktwits shifted to 'bearish' (38/100) on Friday, with users anticipating the company will announce the reverse split after the earnings.

Some users expressed concern that President-elect Donald Trump, known for his skepticism of the clean energy agenda, could negatively impact the EV industry, potentially hurting companies like Luminar that rely on this market.

However, there’s still optimism about the Volvo EX90 launch in September and the integration of Luminar’s tech in the new Mercedes ($MBGAF) GLB electric, which many hope will help boost demand and sales for the company.

The stock is down 71% this year so far.

For updates and corrections email newsroom@stocktwits.com.

Read more: Short Bets Pile Up On Lucid, EVgo, SolarEdge, Sunnova As Bears Brace For Trump-Era Policy Shakeup

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)