Advertisement|Remove ads.

Luxury Furnishing Firm RH Surprises With Q1 Profit: Retail Enthusiasm Jumps As Shares Rally

RH (RH), formerly known as Restoration Hardware, surprised with a quarterly profit on Thursday, sending its shares up over 20% in extended trading.

CEO Gary Friedman's comments about the company taking steps to mitigate the impact of the tariffs, including shifting a significant amount of product out of China, further boosted confidence.

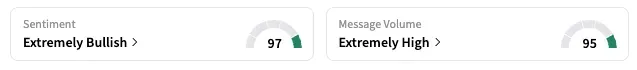

On Stocktwits, retail sentiment for the company climbed several notches higher in the 'extremely bullish' territory. Message volume jumped 920% in the past 24 hours.

A user said, "The upside move was unbelievable but understandable," and several others indicated expectations of the stock reaching $220 levels.

RH is known for luxury home furnishings, including furniture, lighting, textiles, and decor items.

RH's previous earnings call in April coincided with Donald Trump's announcement of all-nation tariffs, prompting Friedman — likely reacting in real-time — to gasp, "Oh sh**," as the company's stock tumbled 40%.

On Thursday, the retailer reported a profit of $8 million for its fiscal first quarter that ended on May 3, compared to a $3.6 million loss last year.

On an adjusted basis, it earned $0.13 per share, compared to analysts' expectations of a $0.09 per share loss.

Revenue rose 12% at $814 million but came in below expectations of $818.6 million.

Friedman said several risks, such as tariffs, market volatility, and a dire housing market, create a challenging business environment, but the company is working on various mitigation efforts.

He said that the percentage of products imported from China would decrease from 16% in the first quarter to 2% in the fourth quarter. Furthermore, by the end of this fiscal year, 52% of the company's upholstered furniture will be produced in the U.S. and 21% in Italy.

The company is maintaining its forecast for 10% to 13% revenue growth this year, assuming existing tariff rates will remain unchanged.

As of their last close, RH shares are down 55% year-to-date to $176.87.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)