Advertisement|Remove ads.

Marathon Holdings’ Stock Sprints As Bitcoin Breaks $84K Post-Trump Win: Capacity Boost Fuels Retail Excitement

Cryptocurrency miner Marathon Holdings Inc ($MARA) shares were among the top 10 trending tickers on Stocktwits on Monday after the firm’s shares jumped nearly 24%.

The surge came on the back of a rise in crypto prices with Bitcoin ($BTC.X) rising by over 5% to top the $84,000 mark for the first time following Donald Trump’s victory in the U.S. Presidential elections. Meanwhile, the ticker gained limelight after the company disclosed an increase in capacity.

Marathon, on Monday, announced the addition of approximately 372 megawatts (MW) of owned and operated compute capacity across three sites in Ohio.

The company said it has acquired the two operational data centers in Ohio with 222 MW of interconnect-approved capacity. The sites have 122 MW of capacity and interconnection approval to expand by another 100 MW, it added.

The firm has also commenced developing a 150-MW operation in Findlay, Ohio, which already has 30 MW of capacity. “These three facilities have a combined interconnect-approved capacity of 372 megawatts, which MARA intends to fully energize by the end of 2025,” the firm said in a statement.

CFO Salman Khan said the data centers will increase the firm’s total owned and operated compute capacity by over 70%. “Owning the sites will provide us with greater operational control and could further reduce our operating costs at the Hopedale data center—previously hosted by the former owner—by up to 50%,” he said.

Throughout the year, the company has secured nearly 1 gigawatt (GW) of nameplate capacity via acquisitions and greenfield site developments. This has taken the company's total nameplate capacity to just under 1.5 GW.

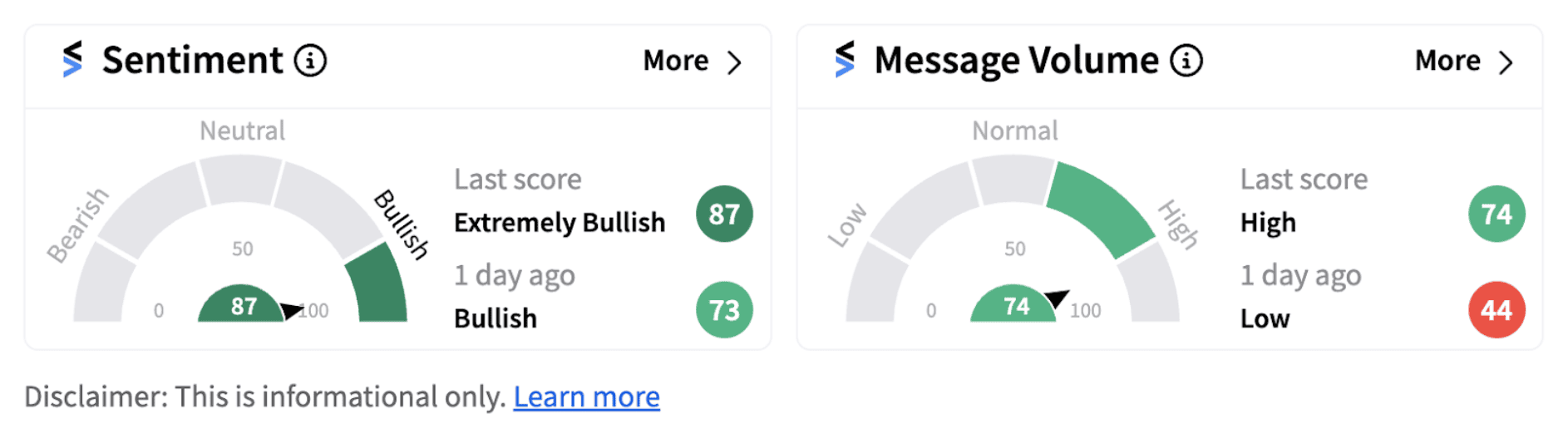

Following the announcement, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (87/100) from ‘bullish’ a day ago, accompanied by high retail chatter.

A good number of Stocktwits followers of the ticker expressed optimism on the shares.

Marathon shares soared nearly 24% on Monday while shares of other crypto-linked companies like Riot Platforms Inc ($RIOT), Bitfarms ($BITF), CleanSpark Inc ($CLSK), and Hut 8 Corp ($HUT) also recorded significant gains.

Also See: AbbVie Stock Declines After Schizophrenia Drug Trials Miss Mark, But Retail Stays Stoic

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)