Advertisement|Remove ads.

Marico Shares Near Record High After Strong Q4: SEBI RA Sanyam Vaish Calls It ‘Classic FMCG Rerating’

Marico is gaining investor attention after reporting its strongest revenue in 14 quarters, with the stock rising over 4% post-earnings and now hovering near its all-time high of ₹735.

SEBI-registered analyst Sanyam Vaish believes this rally is backed by both solid fundamentals and strong technical signals, setting the stage for a potential breakout.

The FMCG major reported a 20% year-on-year increase to ₹2,730 crore, while profit after tax rose 8% to ₹343 crore despite raw material inflation pressures.

The India business saw robust performance, with volumes up 7% and revenues up 23%, and the international segment also posted impressive growth, particularly in the MENA region (+47%) and Bangladesh (+11%).

Marico’s Foods and Premium Personal Care categories — featuring brands like Saffola Oats, Beardo, Just Herbs, and Plix — are now contributing ₹2,000 crore on an annualised run rate, reflecting the success of its premiumisation strategy.

On the technical front, Marico’s share price is trading near ₹726, close to its all-time high of ₹735, supported by a surge in trading volumes and healthy momentum.

Vaish highlights that all major simple moving averages (SMAs) are bullishly aligned, with the 20-day SMA at ₹712 and the 200-day SMA at ₹655 acting as key support levels.

The relative strength index (RSI) is at 65, indicating strong but not overbought momentum, and volume trends confirm bullish sentiment.

He views this as a “classic case of FMCG rerating,” driven by strong results and a “premiumisation” strategy.

As long as the ₹712 support holds, he expects the stock to break above ₹735 and target new highs, with any pullbacks seen as buying opportunities.

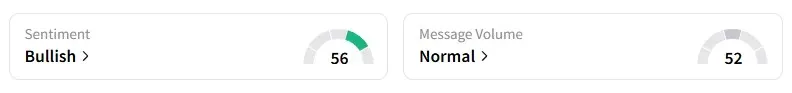

Data on Stocktwits shows that retail sentiment remains ‘bullish’ on this counter.

Marico shares have gained 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)