Advertisement|Remove ads.

Mastek Hits Multi-Month High On AI-Led Growth In Q1: SEBI RA Akhilesh Jat Cautions On Entry Levels

Mastek shares surged nearly 13% in morning trade on Monday, testing the high of ₹2,818, which is the highest level since January 17.

The rally has propelled Mastek to multi-month highs, exceeding all recent price benchmarks and confirming the ongoing strength since its turnaround in April 2025.

At the time of writing, it was up 9%, underscoring intense buying interest following robust quarterly results and positive sector sentiment, according to SEBI-registered analyst Akhilesh Jat.

Why Is Mastek Surging?

According to Jat, the recent move was fueled by outstanding profit growth in its June quarter (Q1 FY26), strong order intake, new client wins, and fresh momentum in AI-led digital deals.

Mastek reported a 28.7% year-on-year increase in its net profit last week to ₹92 crore. However, it also saw its first sequential decline in constant currency revenue after four consecutive quarters of growth, dropping by 1.1%.

Mastek Stock: What Next?

The uptrend, as Jat observed, is characterized by a consistent series of ascending lows, indicating continued market support. The stock's recent sharp rebound from the upward-sloping trendline, which has steered the rally since April, suggests the current momentum is built on strong technical foundations.

However, he cautioned that volatility remains heightened at current levels, making the environment challenging for fresh entries as swift price swings could persist.

Jat identified immediate resistance around ₹2,840, where selling pressure may emerge. He added that the stock may face major resistance at ₹3,100, representing a key hurdle for sustained gains.

Should prices decline, crucial support levels are identified at ₹2,450 and ₹2,224. Given the current sharp volatility and the closeness to established resistance, it would be wise to allow the stock to stabilize before initiating new positions, he concluded.

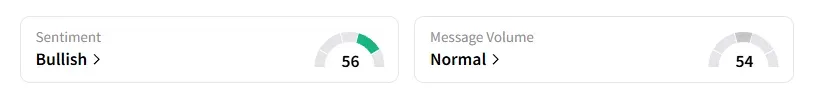

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago on this counter.

Mastek shares have declined 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)