Advertisement|Remove ads.

Maxeon Solar Stock Pops Ahead Of Earnings, Retail Leans Into Short-Squeeze Showdown: ‘Let It Run Forrest Gump Style!’

Shares of Maxeon Solar Technologies, Ltd. ($MAXN) jumped nearly 15% on Thursday, on track for a third straight session of gains, as retail sentiment surged ahead of the company’s earnings report due after market close.

Analysts on average are anticipating adjusted third-quarter (Q3) loss per share to widen to $4.13 from $2.21 a year earlier, with revenue expected to drop to $103.04 million from $227.63 million.

The Singapore-based solar company has faced significant challenges this year amid a broader downturn in the solar energy sector, driven by difficult market conditions, rising borrowing costs, and regulatory shifts that have impacted demand.

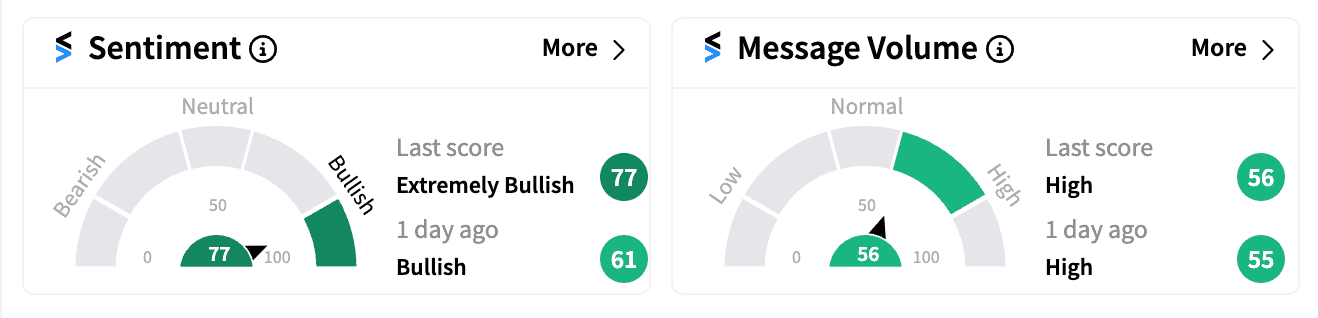

Despite these headwinds, retail sentiment on Stocktwits has turned ‘extremely bullish,’ with MAXN trending among the top 15 tickers and message volume spiking significantly.

Maxeon’s stock has a high short interest, with 35.54% of its float being shorted, according to Fintel data.

Many retail investors view the stock as a “meme stock” and are actively discussing a potential short squeeze.

One bullish user on Stocktwits noted that MAXN was also listed at the top of Fintel’s short-squeeze list on Thursday.

Another goaded holders to not “sell for pennies. The stock is worth at least $30.”

A third user simply wrote, “Let it run Forrest Gump style!”

Maxeon, along with its peers in the renewable energy space, has faced heavy selling pressure since the recent U.S. election, where Republican candidate Donald Trump’s victory raised concerns about potential rollbacks of renewable energy subsidies.

However, there have been some signs of optimism.

Tesla CEO Elon Musk, a major backer of Trump, recently said “solar power will be the vast majority of power generation in the future.”

His company also draws significant revenue from the manufacture of solar panels, roofs and Powerwalls.

This has added to hopes that the President-elect may not entirely undo the renewable energy subsidies introduced during the Biden administration.

MAXN stock has lost nearly 98% of its value so far this year.

For updates and corrections, email newsroom@stocktwits.com

Read next: Disney's Retail Buzz Builds Ahead Of Earnings: What Analysts Are Expecting

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)