Advertisement|Remove ads.

Medtronic Announces Split Of Diabetes Business As Standalone Public Company: Retail’s Unmoved

Medical device maker Medtronic (MDT) said on Wednesday that it is looking to separate its Diabetes business as a standalone public company as a part of its efforts to manage its portfolio.

The separation is expected to be completed within 18 months. The company is eyeing an initial public offering (IPO) and subsequent split-off.

The separation is expected to be accretive to Medtronic’s earnings and operating margin, the company said, while adding that the move would allow it to focus on its other portfolios, including cardiovascular, neuroscience, and medical-surgical.

Que Dallara will be the CEO of the new diabetes company, which is expected to have over 8,000 employees. Dallara is currently the President of Medtronic Diabetes.

Medtronic’s diabetes portfolio reported revenue of $2.76 billion in fiscal year 2025 (FY25), marking a growth of 10.7% year-on-year (YoY), and representing 8% of Medtronic’s total revenue in the period.

The fourth quarter (Q4) was the sixth consecutive quarter the segment reported double-digit organic revenue growth, the company noted.

Medtronic on Wednesday also reported Q4 revenue of $8.9 billion, marking a growth of 3.9% year over year and above an analyst estimate of $8.81 billion, as per Finchat data.

Adjusted and diluted earnings per share for the quarter came in at $1.62, marking a growth of 11% YoY, and above an expected $1.58.

CEO Geoff Martha said the company had a “strong close” to its fiscal year.

"The underlying fundamentals of our business are strong, and they are getting stronger. We are now at an inflection point as we accelerate our speed of travel to higher, more profitable growth," Martha said.

Medtronic expects FY26 revenue growth in the range of 4.8% to 5.1% on a reported basis and adjusted diluted EPS in the range of $5.50 to $5.60 including a potential impact from tariffs. This is, however, below an analyst estimate of $5.84.

While the lower end of the EPS range assumes that higher bilateral US-China tariffs would resume after the ongoing 90-day pause, the higher end assumes that the current tariff rate will continue, the company noted.

Medtronic CFO Thierry Piéton said the company is identifying opportunities to offset a “large portion” of tariffs.

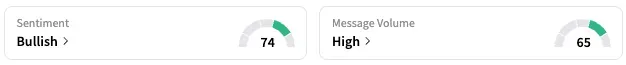

On Stocktwits, retail sentiment around Medtronic stayed unmoved within the ‘bullish’ territory over the past 24 hours while message volume remained at ‘high’ levels

MDT stock is up by about 8% this year and over 1% over the past 12 months.

Also See: Epic Games Wins Ground In Apple Battle As ‘Fortnite’ Reappears On iPhones In US

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)