Advertisement|Remove ads.

Merck Reports Strong Q1 Earnings But Downgrades Full-Year Guidance: Retail Sentiment Brightens

Merck & Co.’s (MRK) first-quarter (Q1) earnings topped estimates, but the company downgraded its full-year profit guidance in light of incremental costs from Trump tariffs and a charge related to a licensing deal with Hengui Pharma.

The biopharmaceutical company reported adjusted diluted earnings per share (EPS) of $2.22, up from $2.07 in the corresponding quarter of 2024, beating an analyst estimate of $2.14, as per FinChat data.

Merck’s total worldwide sales in the three months through the end of March came in at $15.53 billion, down 2% from $15.78 billion in the corresponding quarter of 2024, but above an analyst estimate of $15.33 billion.

Sales from the pharmaceutical segment declined 3% year-over-year (YoY) to $13.64 billion, primarily due to losses from vaccines, virology, and immunology drugs.

Sales of Gardasil, a vaccine that prevents several diseases caused by human papillomavirus (HPV), declined 41% to $1.3 billion, primarily due to lower demand in China.

However, sales of its cancer immunotherapy Keytruda rose 4% to $7.21 billion. Keytruda accounted for over 46% of the company’s total sales in the quarter.

The company revised its full-year earnings estimate in light of Trump‘s imposition of hefty tariffs on imports from China and an anticipated one-time charge related to a license agreement with Hengrui Pharma.

Merck now expects full-year adjusted EPS of $8.82 to $8.97, down from its prior guidance of $8.88 to $9.03.

The company maintained its sales guidance of between $64.1 billion and $65.6 billion.

Merck estimates that the impact of tariffs implemented to date will result in incremental costs of approximately $200 million.

The revised earnings guidance range also reflects an anticipated one-time charge of $200 million for an upfront payment to be made upon closing of the license agreement with Hengrui Pharma, which is expected in the second quarter of 2025.

Merck shares traded over 1% higher in pre-market on Thursday morning.

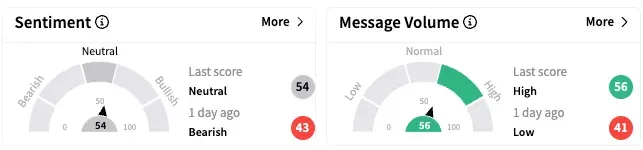

On Stocktwits, retail sentiment around Merck rose from ‘bearish’ to ‘neutral’ territory over the past 24 hours while message volume jumped from ‘low’ to ‘high’ levels.

MRK stock is down by about 21% so far this year and by 38% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)