Advertisement|Remove ads.

MetLife Stock Falls Premarket After Q1 Profit Miss On Investment Income Dip, Retail’s Bearish

MetLife (MET) stock was down marginally in premarket trading on Thursday after the company missed Wall Street’s estimates for quarterly earnings.

On an adjusted basis, the insurer reported earnings of $1.96 per share for the three months ended March 31, while analysts expected it to post $2 per share in earnings, according to FinChat data.

The company’s total revenue rose to $18.57 billion in the first quarter, compared with $16.05 billion in the year-ago quarter.

“We saw favorable underwriting, good volume growth, and better variable investment income in the quarter,” CEO Michel Khalaf said in a statement.

MetLife reported a net income of $879 million, or $1.28 per share, for the reported quarter, compared to $800 million, or $1.10 per share, a year earlier.

Its premiums, fees, and other revenues jumped 14% to $13.64 billion.

However, MetLife’s net investment income fell 10% to $4.9 billion, primarily due to decreases in the estimated fair value of certain securities.

The company also agreed with a unit of Talcott Financial Group to reinsure approximately $10 billion of U.S. retail variable annuity and rider reserves in April.

MetLife said even though the current market environment remains challenging, its team is “up to the task at hand.”

The company also announced a fresh share buyback plan worth $3 billion.

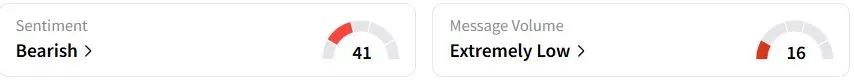

Retail sentiment on Stocktwits was in the ‘bearish’ (41/100) territory, while retail chatter remained ‘extremely low.’

MetLife stock has fallen 8.4% year to date (YTD).

Also See: Robinhood Stock Moves Higher After 50% Q1 Revenue Jump, Share Buyback Boost: Retail’s Elated

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)