Advertisement|Remove ads.

Robinhood Stock Moves Higher After 50% Q1 Revenue Jump, Share Buyback Boost: Retail’s Elated

Robinhood Markets (HOOD) stock gained 1.6% in extended trading on Wednesday after the company’s first-quarter revenue topped Wall Street’s estimates and it boosted its share buyback plan.

The trading platform’s net revenue rose 50% to $927 million for the quarter ended March 31. Analysts were expecting it to post $917.2 million in revenue.

The company reported a net income of $336 million, or $0.37 per share, for the first quarter, compared to $157 million, or $0.18 per share, in the same quarter a year earlier.

The company said its transaction-based revenue rose 77% year-over-year to $583 million, driven by cryptocurrency revenue of $252 million.

President Donald Trump’s favorable policies towards cryptocurrencies have led to a surge in trading volume since his election victory.

The company’s average revenue per user (ARPU) increased 39% to $145 during the first quarter.

“We started the year off strong, driving market share gains, closing the acquisition of TradePMR, and remaining disciplined on expenses,” said Jason Warnick, Chief Financial Officer of Robinhood.

Robinhood also boosted its share buyback plan by $500 million to $1.5 billion. The company expects to buy shares with the remaining $833 million in the program over the next two years.

The company said it is also in discussions with lawmakers and the administration to enable its users to invest in private companies such as SpaceX.

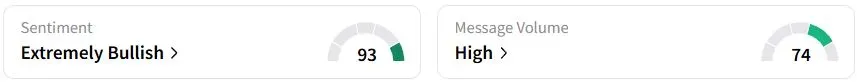

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (93/100) territory, while retail chatter remained ‘high.’

One bullish trader expected the stock to jump to $53 during market hours on Thursday.

Another user said Robinhood is not just a brokerage but “it’s the financial ecosystem of a new generation.”

Robinhood stock has risen 27.4% year-to-date (YTD).

Also See: Crown Castle Stock In Spotlight After Q1 FFO Tops Estimates, Retail’s Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)