Advertisement|Remove ads.

Meta, Google, Netflix Or Disney: Retail Traders Pick Their Favorite Communication Services Stock As Market Navigates Tariff Storm

Communication services stocks have come under pressure amid the broader market downturn, given their reliance on ad spending and exposure to consumers.

Blanket tariffs announced by President Donald Trump on all U.S.'s trading partners and potential retaliatory measures from other nations have set off recession worries, denting the market's risk appetite.

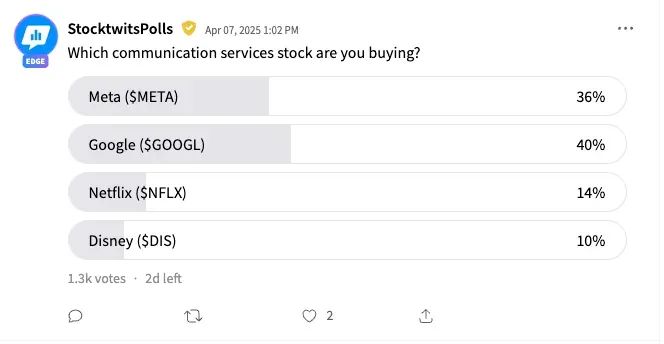

Stocktwits ran a poll to decipher the pulse of retail investors toward some of the high-profile communication services stocks.

The poll, which is ongoing, has so far garnered responses from 1,300 users.

Most respondents (40%) picked Alphabet, Inc. (GOOGL) (GOOG) as the communication stock they were buying amid uncertain times. Meta Platforms, Inc. (META) closely followed with 36% stating that they were accumulating the social media giant’s shares.

Streaming giant Netflix, Inc. (NFLX) was a distant third as it found favor with 14% of the respondents. Traditional media company Walt Disney Co. (DIS) could muster the backing of only 10% of the respondents.

The positive disposition toward Alphabet could be due to the relative stock underperformance, rendering its valuation attractive.

Alphabet stock is down over 23% year-to-date, while Meta and Netflix have pulled back by 13%, and 2%, respectively. However, Disney stock has lost about 27%.

According to Koyfin data, the forward price-earnings (P/E) multiple for the stocks are as follows:

- Alphabet: 16.2

- Meta: 20.3

- Netflix: 35

- Disney: 15.1

Additionally, Meta is more exposed to an ad spending slowdown than Alphabet, given the latter also has a thriving cloud business. The Mark Zuckerberg-led company derived about 97% of its revenue from advertising in the December quarter.

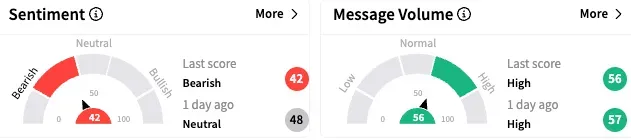

However, Alphabet stock’s retail watchers held a ‘bearish’ view (42/100) by late Tuesday, a deterioration from the ‘normal’ sentiment that prevailed a day ago. The message volume on the stream, however, remained ‘high.’

The pessimism stemmed from recession worries.

The Koyfin-compiled average analysts’ price target for Alphabet, Meta, Netflix and Disney are $214.58, $756.14, $1,070.98 and $125.50, respectively, implying upside potential of 48% each for Alphabet and Meta, 23% for Netflix and 54% for Disney.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)