Advertisement|Remove ads.

Meta Reportedly Begins 5% ‘Performance Terminations’ Monday: Retail Mood Depressed As Stock Trades In Record Territory

Meta Platforms, Inc. (META), which has been vouching for the “efficiency mantra” to counter the softness seen since the abatement of the COVID-19 pandemic, is reportedly gearing to implement another round of layoffs this week.

The Mark Zuckerberg-led company would send notices regarding the layoffs to employees worldwide, beginning at 5 a.m. local time, on Monday, Reuters said, citing an internal memo from Meta’s Head of People Janelle Gale. The executive referred to the cuts as “performance terminations.”

Meta confirmed in January that it would let go of about 5% of its “lowest performers” and backfill at least of its positions.

Based on the headcount disclosed by Meta in its fourth-quarter earnings report, the cut would amount to 3,703 jobs.

Employees in Germany, France, Italy and the Netherlands will not be impacted due to the local regulations in place. At the same time, those in the rest of Europe, Asia and Africa will receive notifications on Feb. 11-18.

Unlike during the previous round of layoffs, Meta will keep its offices open on Monday and refrain from giving further updates.

Meta's post-COVID-19 right-sizing started in Nov. 2022, when it formally announced plans to lay off 10,000 of its employees, accounting for about 13% of its workforce. It followed up with the elimination of another 10,000 workers in March 2023. In the second half of 2024, the ax fell on those employed at Instagram, Facebook Messenger, WhatsApp and Reality Labs.

A separate meme from VP of Engineering for Modernization Peng Fan on Friday reportedly requested help with hiring for machine learning engineers and other “business critical” engineering roles.

The memo confirmed that the process would occur between Feb. 11 and March 13.

Meta reported stronger-than-expected fourth-quarter results in late January, but investors bid down the stock as the midpoint of the revenue guidance for the current quarter trailed the consensus estimate. The stock has since then come back stronger.

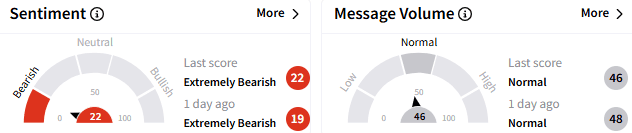

On Stocktwits, retail sentiment toward Meta remained ‘extremely bearish’ (/100), with message volume at ‘normal’ levels.

A platform user thinks the stock should come down by $40 very soon, although they did not clarify whether the view is based on the job cuts.

Another user pointed to a technical chart showing “bearish divergence.”

Meta stock ended Friday’s session up 0.36% at an all-time high of $714.52. The stock has gained nearly 23% so far this year on top of the 66% rally in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)