Advertisement|Remove ads.

Meta Reportedly Plans Standalone AI App To Challenge OpenAI's ChatGPT, Google's Gemini — Retail Isn't Buying The Hype Yet

Meta Platforms, Inc. (META) is said to be stepping on the gas with respect to its artificial intelligence (AI) initiatives.

The Menlo Park, California-based company plans to launch Meta AI, a standalone app, during the second quarter, CNBC reported, citing people familiar with the matter.

The initiative aligns with CEO Mark Zuckerberg’s vision of making Meta a frontrunner in AI technology by the end of the year, overtaking Sam Altman-led OpenAI and Alphabet, Inc. (GOOGL) (GOOG), the report said.

Meta unveiled Meta AI, an AI assistant powered by its Llama 3 large language model, in April 2024. However, it was integrated into Meta’s other apps, such as the flagship Facebook platform, Instagram, WhatsApp, and Messenger. It is also available to users via a website.

The CNBC report also said Meta is contemplating a paid subscription service for Meta AI, similar to how OpenAI and Microsoft charge users to give them access to more powerful versions of their ChatGPT and Copilot chatbots.

Elon Musk’s xAI and Alphabet’s Gemini have launched standalone apps for Grok and Gemini, respectively.

CNBC said that, according to download data provided by Sensor Tower, ChatGPT is currently the most widely used AI-powered digital app. Google’s Gemini, ByteDance’s Doubao, and Microsoft’s Copilot are the other most popular ones behind ChatGPT.

Separately, The Information reported on Wednesday that Meta was in talks to build a new data center campus for over $200 billion.

Subsequently, a Bloomberg report said the company was in talks with Apollo Global Management to lead a $35 billion financing package to help develop U.S. data centers.

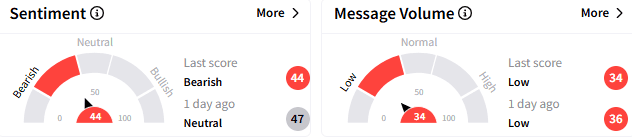

The retail sentiment toward Meta stock worsened to ‘bearish’ (44/100) from ‘neutral’ a day ago and the message volume remained low.

Retail investors appeared to be more worried about the macro fallout from Trump tariffs.

Another flagged a potential correction in Meta’s stock.

Meta ended Thursday’s session down 2.29% at $658.24 amid negative sentiment toward AI stocks. The stock has gained over 12% this year after rallying 66% in 2024.

The stock was on a record 20-session winning streak earlier this month, peaking at $740.91 (intraday) on Feb. 14. Since then, it has declined more than 11%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)