Advertisement|Remove ads.

Micron's Meteoric Year Leaves Nvidia, Other AI Darlings Behind — But Retail Traders Aren't Buying The Hype Yet

- Morgan Stanley analyst predicts serial upward revisions to Micron's earnings estimates.

- A report that the company is investing nearly $10 billion in a Japanese facility to make AI memory chips underscores the healthy demand picture.

- The next significant catalyst for the stock is its fiscal 2026, first-quarter earnings report due on Dec. 17.

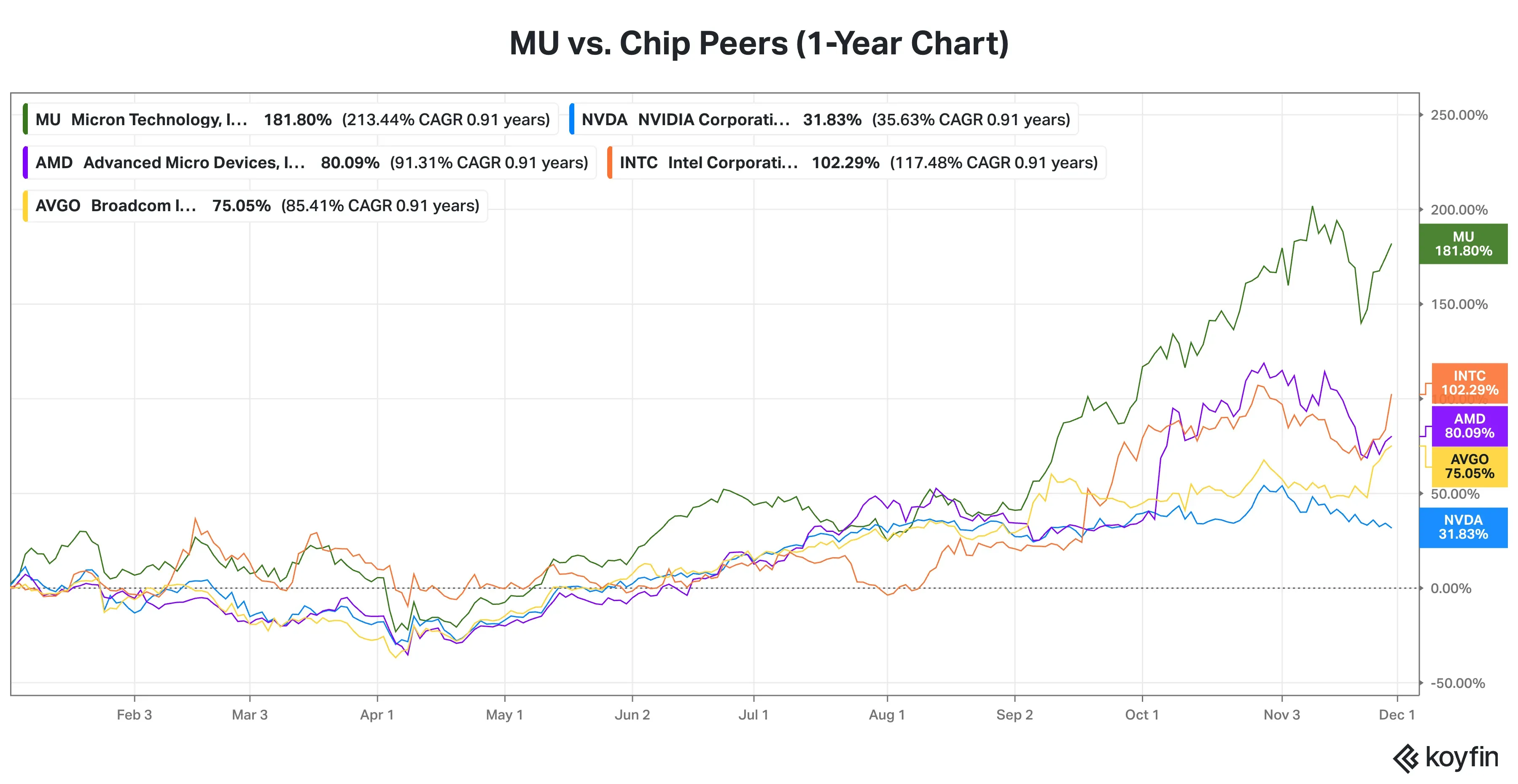

Micron Technology, Inc. (MU) stock is on track to end the year as the best-performing chipmaker this year, beating out artificial intelligence (AI) poster child Nvidia (NVDA) and its peer AMD (AMD). Even Intel (INTC), which received a fresh lease of life following private and government investments and a sharpened focus on execution and cost discipline, could not match up to Micron's scintillating show.

Year-to-date, Micron stock has gained over 180%, outpacing Nvidia's 27% spike and AMD's 80% surge. But retail traders are downbeat on the stock, apparently reflecting their concerns about the market's trajectory. Stocktwits data shows that confidence in MU among retail traders has dipped to 'bearish' levels from 'neutral' a year ago and 'bullish' from three months ago. MU has also added about 10% more watchers on the platform, compared with Nvidia's 14% increase, a sign of slightly softer interest than the company attracting the most AI hype. But are they missing out on a multibagger potential?

For the unversed, Micron is a memory and storage solutions company that manufactures DRAM, NAND, and NOR memory chips. Last month, Micron received a bumper price target hike from Morgan Stanley. In a note released on Nov. 13, the firm's semiconductor analyst, Joseph Moore, raised his price target for the stock by nearly 50% to $325 — a Street-high number. The stock promptly ran up to a record high of $260.58 following the bullish call, only to be dragged by the market-wide tech sell-off.

What Makes MU tick?

Why Morgan Stanley, Baird Are Upbeat

"We are entering uncharted territory, as we have a 2018 style shortage forming but from a much higher EPS starting point," Moore said in the November note. He sees "serial" estimate reratings in the cards.

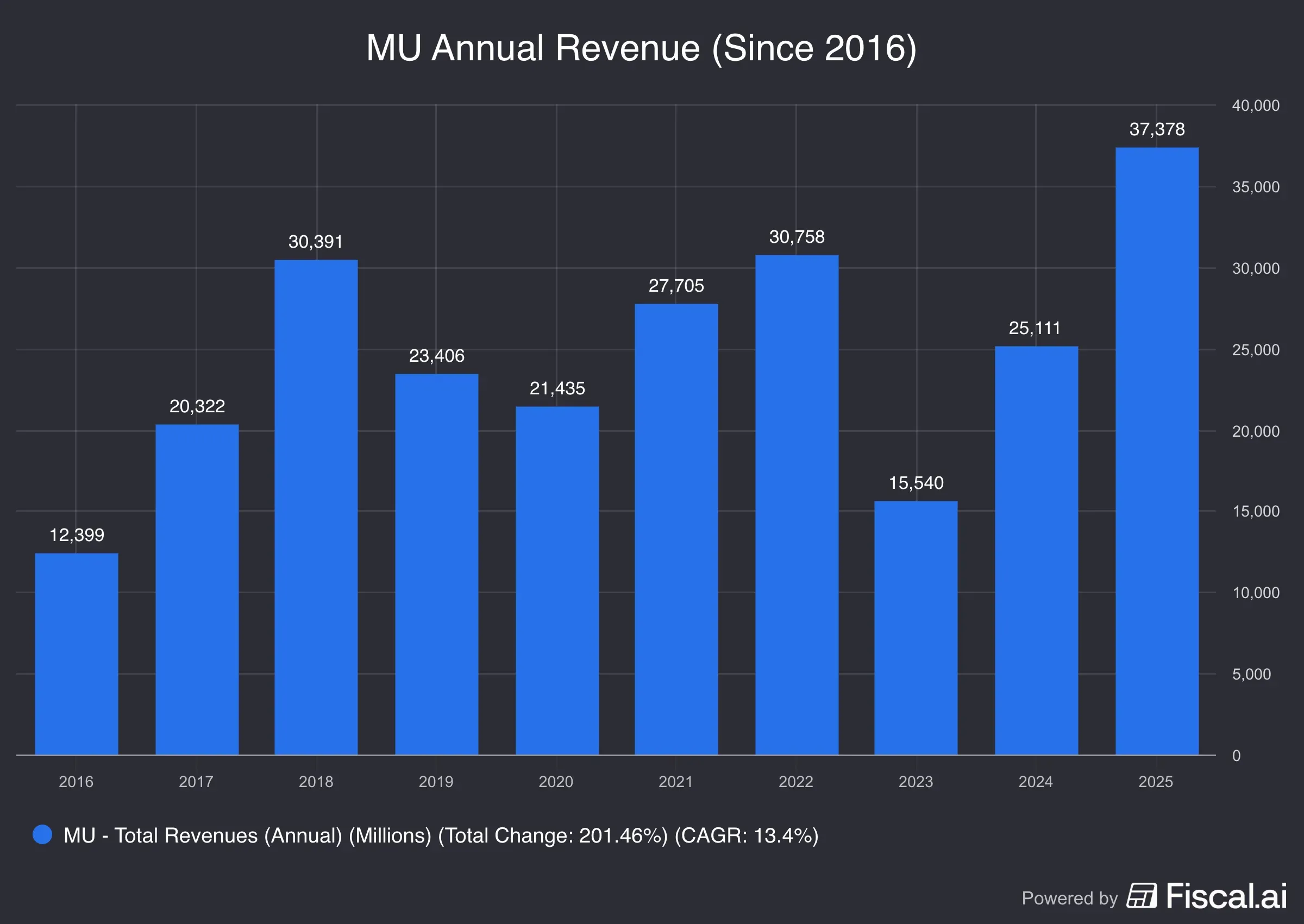

The analyst premised his optimism on Double Data Rate 5 (DDR5) spot pricing tripling in a little over a month. DDR is a type of high-speed computer memory. Micron began the 2018 memory cycle with breakeven earnings, and its earnings are currently at record levels, he said. Annual revenue has surpassed the 2018 levels, currently at $37.38 billion.

Moore believes the stock has yet to price in the whole upside. "At a time when AI sentiment is pricing in positive moves - but still with some anxiety - we see room for further enthusiasm in the story in addition to the jump in earnings power."

Baird analyst Tristan Gerra has an 'Outperform' rating on Micron. "The combination of ongoing supply limitations and accelerating, data centre-driven demand has resulted in an ongoing surge in pricing driving gross margin expansion," he said in a September note.

Citing supply checks, the analyst said he expects the current memory upcycle to extend into 2026. He believes that the company will benefit from strong execution, notably with the ongoing ramp of high-margin, artificial intelligence (AI)-related memory architectures: High Bandwidth Memory (HBM) and LPDDR5. The analyst has a $225 price target for the stock.

Underscoring the demand optimism, the company is reportedly mulling a $9.6 billion investment in western Japan to make AI memory chips, according to a Nikkei report.

Potential Headwinds

Macro and geopolitical factors could pose risks to further gains by impacting the broader market. The market has recovered from the tech sell-off, riding on the hopes that the Federal Reserve will cut rates again in December. If the ongoing worries about an AI bubble temper spending, it could impair analysts' rosy demand outlook for Micron.

The next significant catalyst for the stock is its fiscal 2026, first-quarter earnings report due on Dec. 17. According to the Fiscal.ai-compiled consensus, the company is expected to report adjusted earnings per share (EPS) of $3.78 and revenue of $12.64 billion, up from the year ago's $1.79 and $8.71 billion, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CZ_ZHAO_OG_2_jpg_f6124171e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)