Advertisement|Remove ads.

Microsoft Slips On Soft Q2 Azure Revenue, Below-Consensus Q3 Guidance: Retail Sees Buying Opportunity

Microsoft Corp. (MSFT) shares pulled back in Thursday’s pre-market trading despite the software giant’s fiscal 2025 second-quarter earnings beat.

Traders apparently did not take kindly to the softer quarterly Azure public cloud revenue growth and below-consensus revenue guidance for the running quarter.

Redmond, Washington-based Microsoft reported second-quarter earnings per share (EPS) of $3.23 on revenue of $69.63 billion. This marked an increase from the year-ago numbers of $2.93 and $62.02 billion.

The results exceeded the consensus estimates of $3.11 and $68.87 billion, respectively.

Service revenue accounted for roughly 77% of the total revenue, with products contributing the rest.

Among the business segments, productivity and business processes revenue, which comprises Microsoft 365 commercial and consumer products, LinkedIn, and dynamic products, climbed 14% year-over-year (YoY) to $29.4 billion, accounting for 42% of total revenue.

Intelligent Cloud revenue climbed 19% to $25.5 billion, with Azure and other cloud services revenue rising 31%, in line with the company’s guidance of 31% to 32% but weaker than the previous quarter’s 33% growth.

Meanwhile, More Personal Computing business’s revenue was relatively unchanged at $14.7 billion.

Microsoft noted that its artificial intelligence (AI) revenue surpassed $13 billion in annual run rate.

Gross margin remained unchanged at 69%.

In prepared remarks for the earnings call, CFO Amy Hood said the double-digit top and bottom-line growth was driven by strong demand for the company’s cloud and AI offerings and improved operating leverage.

Microsoft expects adverse currency effects to trim third-quarter revenue by about $1 billion. The segment revenue growth guidance in constant currency is as follows:

- Productivity and business processes - 11%-12% growth

- Intelligent Cloud - 19%-20% growth, with Azure growth at 31%-32%

- More personal computing - $12.4 billion to $12.8 billion

Combined third-quarter revenue guidance is at $67.7 billion to $68.7 billion, below the $69.63 billion consensus estimate.

Microsoft expects capital expenditures for the third and fourth quarters to be flat compared to the second quarter. However, the capex growth rate for the fiscal year 2026 is expected to be lower than that of 2025.

For the fiscal 2025, the company expects double-digit revenue and operating income growth.

Following the results, Microsoft stock snagged a few downward price target adjustments, with Morgan Stanley reducing the price target to $530 from $540 and UBS to $510 from $525, TheFly reported.

Morgan Stanley analysts said Azure revenue growth disappointed but generative AI (GenAI) ramp and moderating capex should boost free cash flow growth in fiscal year 2025.

But tech bull and Wedbush analyst Daniel Ives reiterated an ‘Outperform’ rating and $550 price target.

The analyst said, “The AI piece of the MSFT story was robust and ahead of Street estimates as $13 billion AI ARR was $1 billion above our estimate and thus speaks to the massive momentum Redmond is seeing.”

He said some of the softness in non-AI Azure revenue is more timing or execution driven by the channel, adding that it should rebound in the March and June quarters.

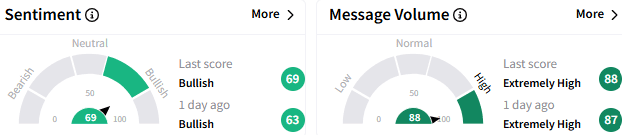

On Stocktwits, retail sentiment toward Microsoft stock stayed ‘bullish’ (71/100) and message volume remained at ‘extremely high’ levels.

Some retail investors on the platform called the earnings report “great” and were perplexed by the stock reaction. A few harbored hopes the stock could rebound at the open.

Another said the post-earnings sell-off has taken the stock close to “buy zone.”

In pre-market trading, the stock was down 4.00% at $424.64.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Meta Tops Q4 Estimates But Offers Lukewarm Guidance: Retail Gets Euphoria As Capex Ramps Up

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)