Advertisement|Remove ads.

Microsoft Investors Await Q3 Results For Clarity On Tariff Impact, Cloud Revenue And AI Economics: Retail Is Bullish

As Microsoft Corp. (MSFT), one of the frontrunners in the artificial intelligence (AI) race, gears up to release its quarterly results, investors look ahead for confirmation regarding a rumored slowdown in its data center plans and tariff impacts on its business.

The software giant is scheduled to announce results for its third quarter of the fiscal year 2025 after the market closes on Wednesday.

The Satya Nadella-led company is widely expected to report adjusted earnings per share (EPS) of $3.22 and revenue of $68.44 billion for the third quarter, up from $2.94 EPS and $61.86 billion for the year-ago quarter.

The guidance issued in late January called for revenue of $67.7 billion to $69.7 billion, with adverse currency impact trimming the topline by an estimated $1 billion.

The company also guided 11% year-over-year (YoY) growth for its Productivity and Business Processes segment and 19%- 20% growth for the Intelligent Cloud business, with Azure revenue estimated at 31%- 32%.

Alphabet’s Google Cloud business, a rival offering to Azure, reported 28% revenue growth for the March quarter.

Microsoft estimated More Personal Computing business revenue to be $12.4 billion to $12.8 billion.

Investors may also keep an eye on the company’s AI revenue, which surpassed an annual revenue run-rate of $13 billion in the previous quarter.

Wedbush analyst Daniel Ives said he expected very strong results from Microsoft, with Cloud revenue showing strength and guidance hitting the Street’s unofficial estimates, often called the whisper number.

Last week, Piper Sandler analyst Brent Bracelin lowered the price target for Microsoft stock to $435 from $520 but kept an ‘Overweight’ rating, The Fly reported.

The price cut was done with an across-the-board reduction for the firm’s application software universe, reflecting near-term headwinds to growth from tariff, policy, and AI adoption hurdles.

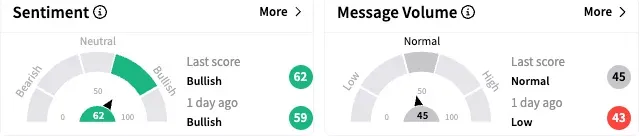

On Stocktwits, retail sentiment toward Microsoft stock stayed ‘bullish’ (62/100), while the message volume was ‘normal.’

A bullish watcher said he expects Microsoft and Meta to report top- and bottom-line beats and raise its guidance due to strong AI-related demand.

Another user said the stock will likely move toward $420 after earnings.

Microsoft stock ended Tuesday’s session up 0.47% at $394.04 but is down 6% this year. The stock trades well off its all-time high of $468.35, reached in July 2024.

The recent declines amid the tariff turmoil have rendered its valuation attractive, with the stock trading at a more reasonable forward price-earnings (P/E) multiple of 28.6.

The Koyfin-compiled analysts’ consensus price target is $490.38, implying an upside potential of 25%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Meta Retail Traders Bullish Ahead Of Q1 Print But Analyst Wary Of Tariff Pressure On Guidance

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)