Advertisement|Remove ads.

MicroStrategy Raises $1.01B Via Convertible Notes Offering, Accumulates More Bitcoins: Retail Stays Bullish

MicroStrategy (MSTR) said on Friday it has completed raising $1.01 billion through an offering of convertible senior notes due 2028 to qualified institutional buyers. Shares of the firm were trading over 1% higher.

The net proceeds will be used to redeem $500 million of its outstanding senior secured notes due 2028, to acquire additional bitcoins (BTC.X), and for general corporate purposes.

Upon redemption of the senior secured notes, all collateral securing the debt, including approximately 69,080 bitcoins, will be released, the firm said.

MicroStrategy considers itself as a Bitcoin development company, using cash flows and proceeds from equity and debt financings to accumulate the cryptocurrency, which serves as its primary treasury reserve asset.

The firm said in an SEC filing that during the period between September 13, 2024 and September 19, 2024, it acquired approximately 7,420 bitcoins for approximately $458.2 million in cash, at an average price of approximately $61,750 per bitcoin, inclusive of fees and expenses.

The firm uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner it believes is accretive to shareholders. As of Thursday, MicroStrategy, together with its subsidiaries, held an aggregate of approximately 252,220 bitcoins, acquired at an aggregate purchase price of approximately $9.90 billion and an average purchase price of approximately $39,266 per bitcoin, inclusive of fees and expenses.

Interestingly, MSTR shares have gained over 112% since the beginning of the year while Bitcoin prices have returned only 42% during the period.

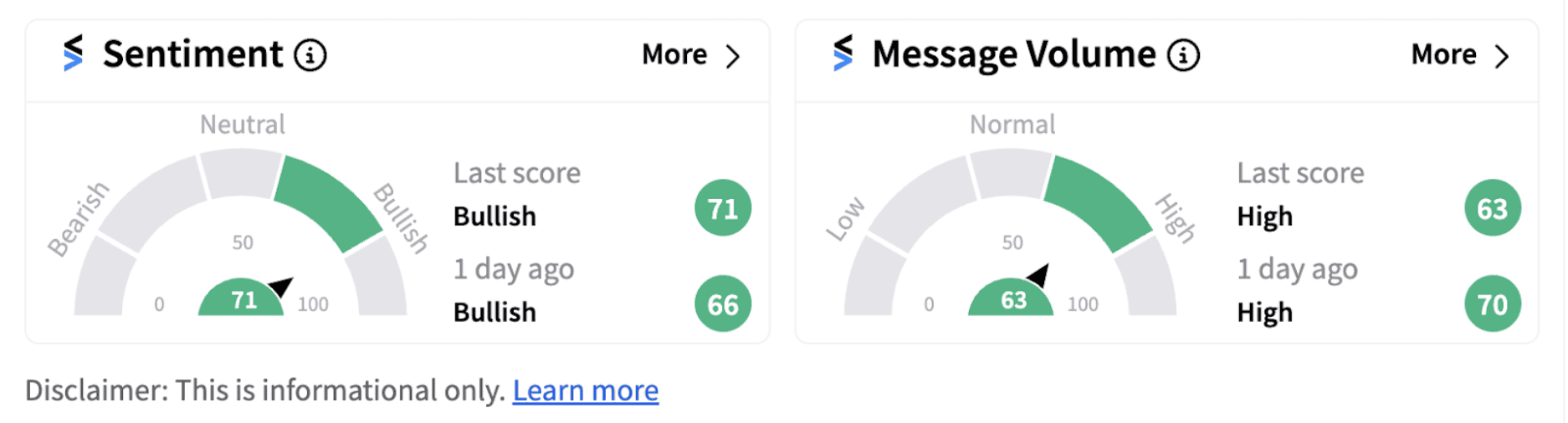

Following the fund-raising announcement, retail sentiment on Stocktwits shifted further into the ‘bullish’ territory (71/100), accompanied by high message volumes.

Recently, Canaccord Genuity reportedly lowered its price target on the stock from $185 to $173, while maintaining a ‘Buy’ rating.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)