Advertisement|Remove ads.

Mondelez Retail Investors Unimpressed After Wells Fargo Upgrades Rating

Wells Fargo raised its rating and price target on Mondelez International (MDLZ) shares, sending the stock up 3% on Friday. However, it failed to have an impact on retail investors' sentiment, which remained low.

The investment advisor upgraded the rating to 'Overweight' from 'Equal Weight.' The price target was raised to $78, up from $68, indicating a 14% upside from current levels.

"While the company is confronting historical inflation in 2025, 1) pricing execution has been strong, 2) inflation looks likely to temper in 2026, and we see a recovery of earnings ahead," the analysts wrote, according to The Fly.

The low relative valuation creates the "optimal bull case." Mondelez shares are up 14.4% year-to-date.

The recent decline in cocoa prices may also provide some tailwinds. Mondelez is best known for Cadbury chocolates, Oreo biscuits, and Bournvita drink mix and has dozens of other popular products.

Currently, 19 of the 27 analysts covering the stock rate it 'buy' or higher, and eight rate it 'hold,' according to Koyfin data. Their average price target is $63.31.

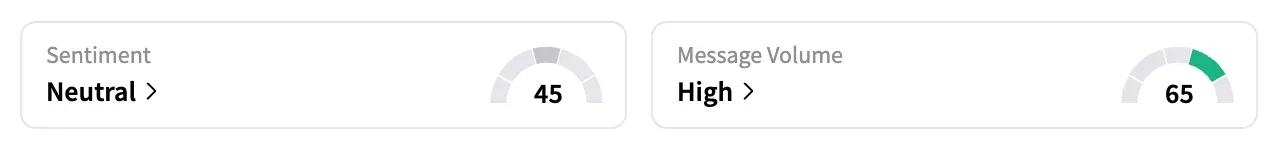

On Stocktwits, the retail sentiment for Mondelez was 'bearish,' unchanged from a month ago.

The latest rating action comes as Mondelez reported higher-than-expected profit in the last quarter, helped by several rounds of price hikes and new product launches.

The company also maintained its annual forecast, even as peer consumer majors like Kraft Heinz, General Mills, and PepsiCo have trimmed theirs.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244672917_jpg_95b721e1af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195597245_jpg_c1df83b829.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_BTC_ETH_OG_jpg_566a59dd7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2189355808_jpg_c13dd12a0f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195599761_jpg_ec0e618b8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)