Advertisement|Remove ads.

Morgan Stanley Raises Chewy’s Price Target To $30: Is Retail Happy?

Morgan Stanley has reportedly raised the price target on Chewy to $30 from $28 while maintaining an ‘Overweight’ rating on the stock.

The brokerage reportedly expects the pet food company to deliver a strong earnings before interest, tax, depreciation, and amortization (EBITDA) margin and hike its guidance during the second-quarter results scheduled to be announced before the bell on Wednesday. The stock, however, declined over 3% on Monday.

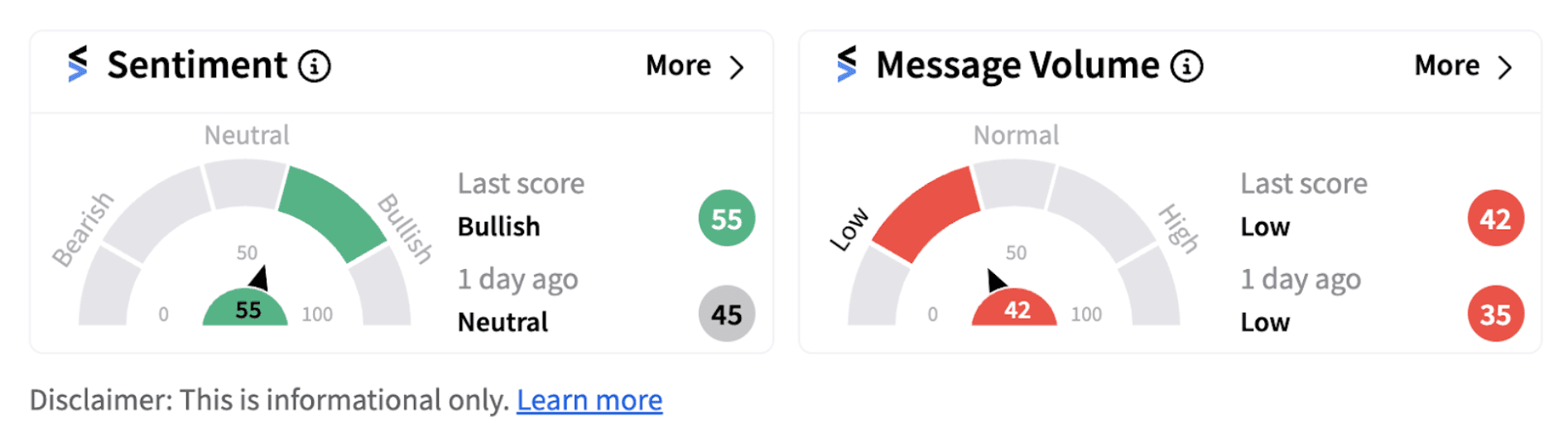

Following the development, retail sentiment on Stocktwits shifted into ‘bullish’ territory (55/100) from ‘neutral’ zone a day ago.

Retail followers of Chewy on Stocktwits expressed enthusiasm as well, believing the firm will beat analyst estimates in its upcoming earnings.

Some users, albeit bullish, are maintaining a more cautious approach toward the stock. For instance, one user named ‘Crazybirdguy’ noted they don’t expect any real push until the third-quarter earnings but said it's a long-term holding.

The stock made headlines last month after Keith Gill a.k.a ‘Roaring Kitty’ disclosed a stake in the firm. From a performance point of view, the stock has had a decent year, having gained over 16% on a year-to-date basis. However, much of the gains were recorded after the firm’s strong first-quarter results.

Chewy’s net income almost tripled to $66.90 million during the first quarter versus the same period a year ago. It delivered a record EBITDA of $162.92 million, up 47% year-over-year (YoY).

Notably, in June, the company announced it will repurchase an aggregate of 17.55 million shares of its Class A common stock at a price per share of $28.49 resulting in an aggregate repurchase price of approximately $500 million from Buddy Chester Sub LLC. The entity is affiliated with funds advised by BC Partners Advisors, Chewy’s largest shareholder.

Analysts now expect the firm to report revenue of $2.86 billion and EBITDA of $112.53 million during the second quarter. Earnings per share is estimated to come in at $0.21.

Going forward, a lot will depend on whether the firm manages to meet Wall Street expectations. The stock is currently trading above the 200-day moving average but faces resistance at the $28 mark.

Also See:

Southwest Airlines Stock Faces Scrutiny As Elliott Pushes For New Leadership, Board Oversight

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitdeer_0adcf9a760.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254687746_jpg_9f8228b6ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)