Advertisement|Remove ads.

Most Retail Traders Expect Fed Pause, But Some Still Hope For A Rate Cut Amid Uncertain Times

The Federal Reserve is all set to announce its second rate decision for the year on Wednesday afternoon, and the market has priced in a status quo stance amid fluid macroeconomic and geopolitical conditions.

Following two days of deliberations, the central bank's rate-setting committee, the Federal Open Market Committee (FOMC), will release a post-meeting policy statement at 2 p.m. ET. The Fed is also set to release its Summary of Economic Projections (SEP), comprising its updated economic growth and inflation forecasts and the dot-plot curve.

The dot-plot curve is a chart showing the FOMC members' projection of the Federal funds rate in the near to medium term.

A press briefing hosted by Chair Jerome Powell will follow at 2:30 p.m. in which he will explain away the decision and take questions.

A Stocktwits poll that probed users' expectations of the Fed decision showed that a majority (60%) leaned toward a pause decision. Half as many users (30%) hoped for a surprise cut, and 10% expected a surprise rate hike.

Commenting on the poll, a user said he expects a hold decision in March and a cut in May. Another user said they expect Powell to criticize the tariffs and delve into how they will hurt the economy.

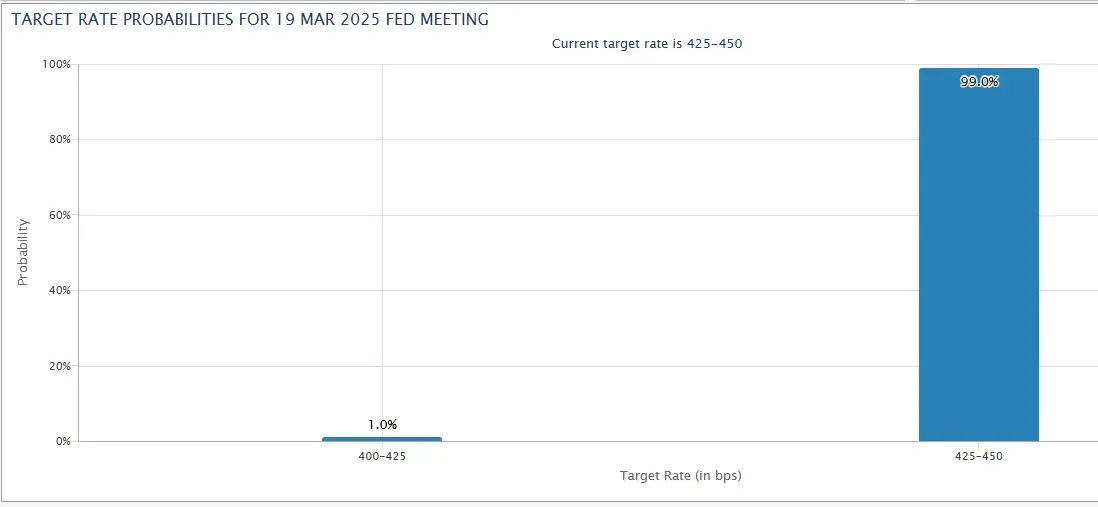

The expectation aligns with the one that is baked in by the futures market. The CMEFedWatch tool showed a 99% probability of the Fed funds rate remaining unchanged at 4.25%-4.50%. Only 1% expect a 25-basis-point cut to 4.00%-4.25%.

Economic data released since the last meeting held on Jan. 28-29 have been mixed, with most lagging indicators performing decently. However, leading indicators such as consumer sentiment have worsened due to fears that President Donald Trump’s tariffs will derail global economic growth.

The Trump administration imposed 25% tariffs on imports from Mexico and Canada as well as increased tariffs on Chinese goods to 20% earlier this month.

However the goods and services converted by the United States-Mexico-Canada Agreement (USMCA) were exempted from the additional levy until April 2 when the reciprocal tariffs on the other countries would take effect.

U.S. neighbors and China have taken retaliatory measures to various degrees, setting off fears of a global trade war, which has proved negative for the financial markets.

Higher tariffs have the potential to reignite inflation, a key metric the Fed uses while finalizing its policy moves. The February inflation report released last week showed that annual core consumer price inflation was 3.1%, the lowest since April 2021.

Comerica Chief Economist Bill Adams said that while a pause decision is factored in, the markets will closely scrutinize policymakers’ economic and interest rate forecasts and Powell’s comments for clues about the future path of monetary policy.

He also said the FOMC could unveil plans to pause or end its balance sheet reduction program, aka “quantitative tightening.”

Fund manager Louis Navellier said he expects the updated dot-plot curve to signal two more rate cuts this year. However, he looks forward to four cuts because he expects global interest rates to crash as the global economic growth slows or enters contraction.

The rate move is significant for the market as the S&P 500 Index, a broader gauge, is trading with a nearly 10% loss from its recent high, and the heavily weighted “Magnificent Seven” stocks are all down for the year.

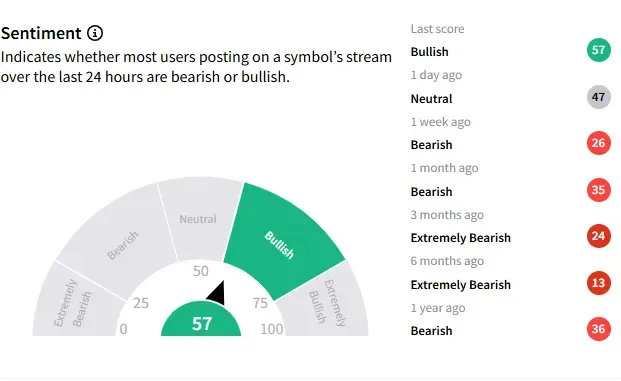

Retail sentiment toward the SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) tracking the performance of the S&P 500 Index has improved to ‘bullish’ (57/100) from ‘neutral’ a day ago and ‘bearish’ a week ago.

The SPY ETF ended Tuesday’s session down 1.08% at $561.02, taking its year-to-date loss to 4.28%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)